Fund Managers Are Scaling Back on Bonds and Picking Up Gold

This article was originally published on ETFTrends.com.

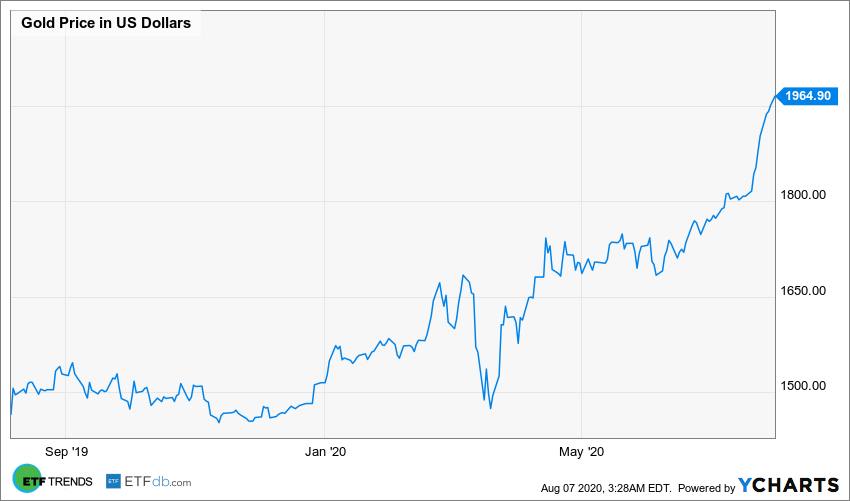

Bonds were the capital markets’ darling amid the initial sell-offs due to the Covid-19 pandemic as investors rushed to safe havens like Treasury debt. However, with yields at record lows, fund managers at institutional investors are scaling back on bonds and taking in more gold.

Per a Bloomberg report, fund managers “like Plurimi Wealth LLP’s Chief Investment Officer Patrick Armstrong are a case in point. Armstrong has cut back on bonds and now holds 7.5% of the firm’s balanced portfolios in gold -- the most ever. He also started buying gold-mining equities in March. The allocation shift is an about-turn for the investor who was shorting bullion five years ago when prices languished near $1,100 an ounce compared with $2,040 today.”

“The reason I want to hold gold is because the future is just going to be a continuation of what’s happening now: more money printing,” Armstrong said.

As such, a devaluation in the greenback could spur more investors to hold more gold as a store of value. Even if investors don’t want to hold physical gold, they have options to invest in the precious metal via exchange-traded funds (ETFs).

Gold’s recent rally is the stuff of precious metal investors’ dreams as the commodity continues to gain amid the uncertainty of the Coronavirus pandemic. As the demand for safe havens like precious metals continues, this only helps to fuel gold-backed funds like the VanEck Merk Gold Trust (OUNZ).

OUNZ seeks to provide investors with an opportunity to invest in gold through the shares and be able to take delivery of physical gold in exchange for those shares. The Trust’s secondary objective is for the shares to reflect the performance of the price of gold less the expenses of the Trust’s operations.

Each share represents a fractional undivided beneficial interest in the Trust’s net assets. The Trust’s assets consist principally of gold held on the Trust’s behalf in financial institutions for safekeeping.

Gold Price in US Dollars data by YCharts

OUNZ offers investors:

Deliverability: VanEck Merk Gold Trust holds gold bullion in the form of allocated London Bars. It differentiates itself by providing investors with the option to take physical delivery of gold bullion in exchange for their shares.

Convertibility: For the purpose of facilitating delivery, Merk has developed a proprietary process for the conversion of London Bars into gold coins and bars in denominations investors may desire.

Tax Efficiency: Taking delivery of gold is not a taxable event as investors merely take possession of what they already own: the gold.

For more market trends, visit ETF Trends.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM