Further Divergence Between Revenue and Earnings Doesn't Bode Well for C3.ai (NYSE:AI)

This article first appeared on Simply Wall St News.

After losing over 70% of the value since its IPO, it would be hard not to classify C3.ai, Inc.(NYSE: AI) as a busted IPO.

While many tech stocks have been under pressure lately, C3.ai has been in a sustained downtrend over a year ago. Meanwhile, the company is changing the 3rd CFO in 17 months, and short interest is rising.

See our latest analysis for C3.ai.

Earnings Results

Non-GAAP EPS: -US$0.07 (beat by US$0.19)

Revenue: US$69.77m (beat by US$2.61m)

Revenue growth: +42.1% Y/Y

FY 2022 guidance: raised to US$252m

Since 2013, the company has gone through 7 CFOs (3 in the last 17 months). The latest to get appointed is Juho Parkkinnen, replacing Adeel Manzoor (appointed on December 1, 2021).

While frequent changes in such an important position certainly do not inspire optimism, institutions seem to be losing patience with the company. Deutsche Bank just downgraded the stock from Hold to Sell and halved the price target from US$36 to US$18. Their analyst Patrick Colville noted that they don't believe the company will meet the preliminary guidance of beating fiscal 2022 in fiscal 2023.

Deutsche Bank certainly isn't lonely in its view, as 2 weeks ago, Spruce Point issued a new short report, seeing the price target at US$12.85-15.40 per share. This is approximately a 40% downside from the current trading prices.

The Results so Far

C3.ai isn't currently profitable, so most analysts would look to revenue growth to understand how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, C3.ai increased its revenue by 29%. We think that is pretty nice growth. Unfortunately, the market wanted something better, given it sent the share price 74% lower during the year. One fear might be that the company might lose too much money and need to raise more. It seems that the market has concerns about the future because that share price action does not seem to reflect the revenue growth at all.

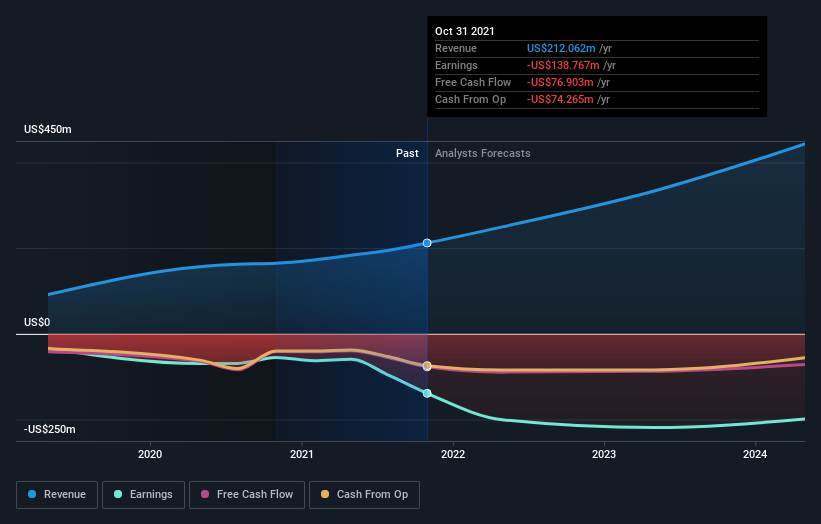

The image below shows how earnings and revenue have tracked over time (if you click on the image, you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for C3.ai in this interactive graph of future profit estimates.

More of the Same

While the stock lost 74% in the last year, it lost another 30% over the previous 3 months, so the market doesn't seem to believe that the company has solved all its problems. Most investors should be wary of buying into a poor-performing stock unless the business itself has clearly improved.

Observing the earnings and revenue growth above, one particularly concerning fact, is the divergence between the revenue and earnings, signaling that the expenses are rising.

While observing the price movement and institutional coverage is helpful, to truly gain insight, we need to consider other information, too. Case in point: We've spotted 4 warning signs for C3.ai you should be aware of, and 1 of them makes us a bit uncomfortable.

For those who like to find winning investments, this free list of growing companies with recent insider purchasing could be just the ticket.

Please note the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.