Further weakness as Array Technologies (NASDAQ:ARRY) drops 10% this week, taking one-year losses to 72%

As every investor would know, you don't hit a homerun every time you swing. But it should be a priority to avoid stomach churning catastrophes, wherever possible. So spare a thought for the long term shareholders of Array Technologies, Inc. (NASDAQ:ARRY); the share price is down a whopping 72% in the last twelve months. A loss like this is a stark reminder that portfolio diversification is important. Array Technologies may have better days ahead, of course; we've only looked at a one year period. Shareholders have had an even rougher run lately, with the share price down 23% in the last 90 days.

If the past week is anything to go by, investor sentiment for Array Technologies isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Array Technologies

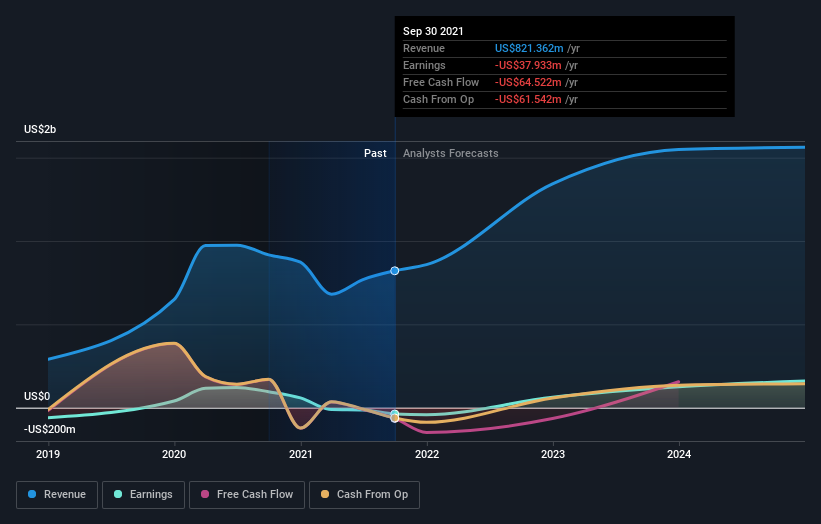

Given that Array Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Array Technologies' revenue didn't grow at all in the last year. In fact, it fell 10%. That looks pretty grim, at a glance. The market obviously agrees, since the share price tanked 72%. Holders should not lose the lesson: loss making companies should grow revenue. Of course, extreme share price falls can be an opportunity for those who are willing to really dig deeper to understand a high risk company like this.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While Array Technologies shareholders are down 72% for the year, the market itself is up 15%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 23% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand Array Technologies better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Array Technologies you should be aware of, and 1 of them shouldn't be ignored.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.