G-III Apparel's (GIII) Q4 Earnings Beat Estimates, Sales Down Y/Y

Shares of G-III Apparel Group, Ltd. GIII grew 3.4% during the trading hours on Mar 18, following its better-than-expected earnings in fourth-quarter fiscal 2021. Notably, the quarter marked the third straight earnings beat. Also, the company’s digital business continued to exhibit strength. The company’s own websites generated solid results for both DKNY and Karl Lagerfeld Paris, with comparable sales growth of about 40%.

Q4 in Detail

G-III Apparel delivered adjusted earnings per share of 47 cents that surpassed the Zacks Consensus Estimate of 23 cents. However, the figure suggests a decline of 37.3% from 75 cents earned in the year-ago period. We note that the company delivered GAAP earnings of 30 cents a share, inclusive of a net loss of 17 cents a share from the Wilsons Leather and G.H. Bass store operations. It had recorded a net loss of 33 cents a share in the year-ago comparable period.

Markedly, G-III Apparel has completed the restructuring of the retail segment, thereby permanently shutting the Wilsons Leather and G.H. Bass stores.

Net sales plunged 30.3% year over year to $526.2 million and lagged the Zacks Consensus Estimate of $534 million, after reporting a beat in the previous quarter. Soft top-line performance can be attributed to a decline in sales at both the wholesale and retail divisions.

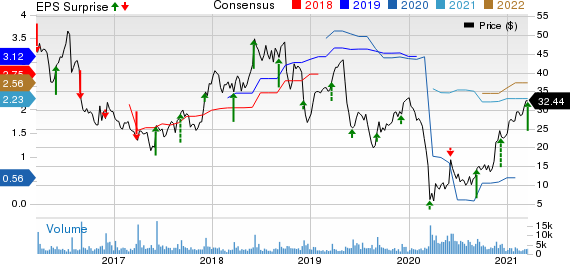

GIII Apparel Group, LTD. Price, Consensus and EPS Surprise

GIII Apparel Group, LTD. price-consensus-eps-surprise-chart | GIII Apparel Group, LTD. Quote

Moreover, gross profit declined 25.3% year over year to $187.6 million. However, gross margin of 35.6% increased 230 basis points (bps) from the prior-year period, mainly driven by a higher gross margin in the Wholesale segment, partly offset by a contraction in the metric at the Retail unit.

However, SG&A expenses declined nearly 20% year over year to $151 million on cost-control efforts undertaken amid the pandemic. We note that the company has streamlined the headcount in its global wholesale operations.

Further, the company reported operating income of $27.5 million, which decreased about 14.9% from the year-ago quarter.

Over the past three months, shares of this Zacks Rank #3 (Hold) company have increased 45.5%, outperforming the industry’s 2.6% growth.

Segmental Performance

Net sales at the Wholesale segment were $488 million, down roughly 23% year over year. However, the segment’s gross margin rose 550 bps to 35.5% from the year-ago quarter, benefiting from the reversals of increased royalties, which were earlier accrued on favorable negotiations with the licensors.

Net sales at the Retail segment totaled $44 million, down nearly 66% from the prior-year quarter’s reported figure. The metric included $15 million of sales for the Wilsons Leather and G.H Bass stores compared to $86 million in the prior-year period. The segment’s gross margin also contracted to 32.2% from 45.9% in the year-ago quarter, mainly due to the final stages of store liquidations for Wilsons Leather and G.H Bass outlets.

Other Details

G-III Apparel witnessed accelerating demand for athleisure across its brands throughout the reported quarter. Moreover, it sees opportunities to grow athleisure for its power brands, including Calvin Klein, Tommy Hilfiger, DKNY and Karl Lagerfeld Paris. The company’s casual offerings have also been driving the sportswear category. Also, the footwear and handbag businesses continued to remain strong.

Recently, the company has also launched the Karl Lagerfeld Paris women's brand across 75 new doors at Macy's M. Additionally, the company’s Donna Karan International acquisition appears encouraging. In fact, International is a key growth opportunity for the company.

We note that management is focused on growing the digital business with expansion in the distribution channel. It is on track to drive growth across the digital landscape via investments in internal talent, re-platformed e-commerce sites, improved logistics capabilities along with a new CRM and loyalty program. The company entered fiscal 2022 with a healthy inventory position.

Financial Details

G-III Apparel ended fourth-quarter fiscal 2021 with cash and cash equivalents of $351.9 million and long-term debt of $512.4 million. Total stockholders’ equity was $1,336.2 million. Further, inventories declined nearly 25% to $416.5 million at the end of the reported quarter. At the quarter-end, it had available cash under its credit agreement of about $825 million.

Moreover, the company ended fiscal 2021 with an improved net debt position of $160 million versus $200 million at the end of the prior year.

Outlook

Due to the ongoing pandemic-related uncertainties, management issued guidance for the first quarter of fiscal 2022 only. For the fiscal first quarter, the company projects net sales of roughly $460 million, which suggests an increase of 13.6% from $405.1 million in the year-ago quarter . Excluding sales of $19 million from the shuttered Wilsons Leather and G.H. Bass outlets in the first quarter of fiscal 2021, net sales would have been about 19% higher. For the fiscal first quarter, gross margins are likely to significantly improve year over year.

Moreover, GAAP net income is anticipated in a band of 5-15 cents per share against GAAP net loss of 82 cents recorded in the year-ago period.

Don’t Miss These Solid Bets

Gildan Activewear GIL has a long-term earnings growth rate of 9% and currently, a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here..

Crocs CROX has a long-term earnings growth rate of 15% and a Zacks Rank #2 (Buy).

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macys, Inc. (M) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research