Gas prices will likely wipe out Trump tax cut gains for millions

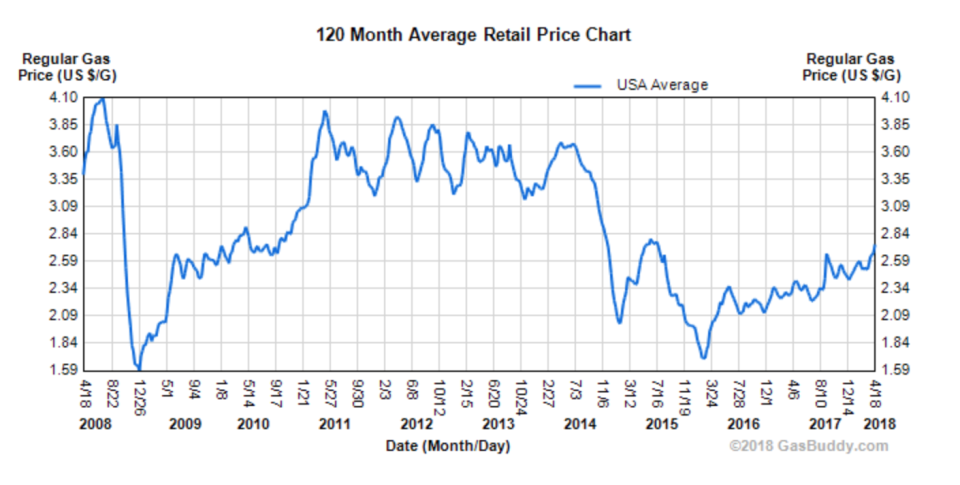

Gas prices have risen this month. And if they rise $1.05 per gallon off their current marks, it would eat the disposable income gains of last year’s tax cut legislation, according to Deutsche Bank analysis.

The national average is now $2.76 a gallon, according to GasBuddy, which is close to the most recent high in mid-2015. A $1 gain per gallon would represent a full return to the soaring prices of 2014, when the average price for a gallon approached $3.70. From 2011 to mid-2014, prices were at this level.

While a $1 increase would be required to cancel out benefits for families of all income levels, lower-income families’ gains would be wiped out much more quickly.

In fact, Deutsche Bank analysts expect this to happen sometime this year for these lower-income groups, as the rise in disposable income gets eclipsed by rising oil and gas prices.

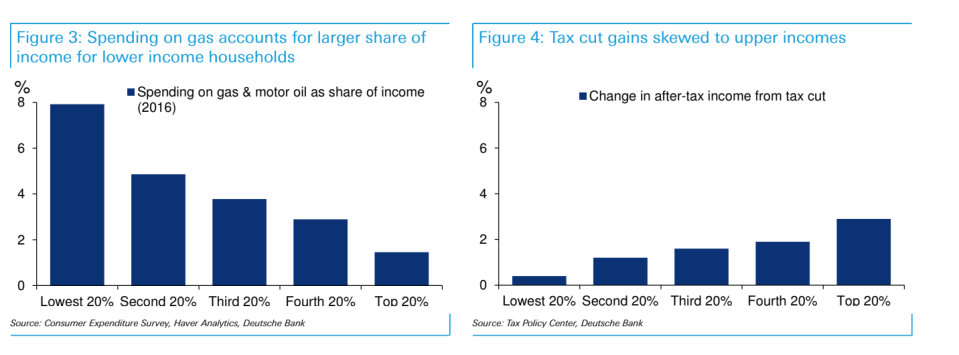

Lower-income families usually spend a higher percentage of their budget on gas, making price changes more pointed. The lowest-earning 20% of American families spend 8% of their household budget on gas and oil. For the top 20%, it’s less than 2%.

But that’s not the only factor. The tax cuts heavily favor wealthier households, giving them more of a push even if they’re paying more in gas. For the bottom 20% of families by income, the tax cut gains are only around $50, according to the U.S. government’s Joint Committee on Taxation. At the same time, a household that earns $200,000 would save $12,000. At 2014 prices — the worst-case of gas prices in recent memory — that would pay for 81,075 miles in a 25 mpg vehicle.

According to Deutsche Bank, the relationship of disposable income and energy has long been a tight one. For every one-cent rise in gas prices, consumer spending on non-energy goods and services has fallen $1.16 billion. So thus far, from last year, analysts are expecting a reduction of income allocated to non-energy stuff to fall by $35 billion.

—

Ethan Wolff-Mann is a writer at Yahoo Finance. Follow him on Twitter @ewolffmann. Confidential tip line: FinanceTips[at]oath[.com].