GATX Stock Down 6.3% Since Q1 Earnings Release: Here's Why

GATX Corporation’s GATX first-quarter 2022 earnings (excluding 24 cents from non-recurring items) of $2.34 per share surpassed the Zacks Consensus Estimate of $1.37. The bottom line surged more than 100% year over year.

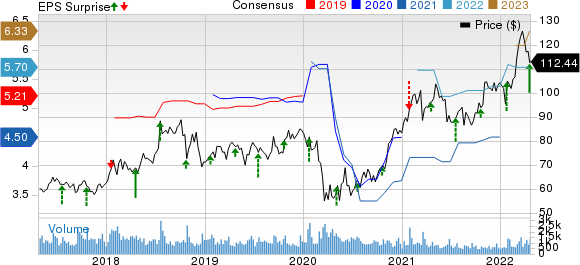

GATX Corporation Price, Consensus and EPS Surprise

GATX Corporation price-consensus-eps-surprise-chart | GATX Corporation Quote

The performance on the top-line front was not so impressive with total revenues improving only 3.5% to $316.8 million. Moreover, despite a solid demand scenario with economic activities gaining pace, GATX did not raise its earnings (excluding the impact of Tax Adjustments and Other Items) guidance for 2022 and still expects the metric in the $5.50-$5.80 per share range. The midpoint of the guided range (i.e. $5.65 per share) is below the Zacks Consensus Estimate of $5.70.

The not-so-encouraging revenue performance and the intact EPS guidance might have disappointed investors. As a result, the stock has lost 6.3% of its value since the earnings release on Apr 20, before the market opened on that day.

Coming back to the first-quarter earnings report, lease revenues, which contributed 89.5% to the overall top line, increased marginally year over year to $283.3 million. Marine operating revenues contributed 1.96% to the top line of GATX, currently carrying a Zacks Rank #2 (Buy), and increased to $6.2 million from $3.6 million a year ago. The rest came from other sources. Total expenses (on a reported basis) declined marginally to $235.7 million.

Segmental Details

Profits in the Rail North America segment soared 83% year over year to $120.4 million. The upside was primarily led by higher gains on asset dispositions. The renewal lease rate change of GATX’s Lease Price Index (LPI) was 9.3% in the reported quarter against the year-ago quarter’s -18.1%. The average lease renewal term for cars included in the LPI was 30 months, flat year over year.

In the Rail International segment, profits rose 14.2% year over year to $24.9 million in the first quarter. Results were primarily driven by more railcars on lease. Rail North America’s wholly-owned fleet consisted of approximately 110,700 rail cars at the end of Mar 31, 2022. Fleet utilization was 99.3% compared with 97.8% at the end of first-quarter 2021.

GATX Rail Europe’s fleet totaled around 27,200 rail cars at the end of the quarter. Fleet utilization was 99% in the reported quarter compared with 98.2% at the end of the first quarter of 2021.

The Portfolio Management unit reported a segmental loss of $3.9 million in the March quarter against a profit of $6.1 million in the year-ago quarter. In the same period, the Rolls-Royce and Partners Finance affiliates terminated leases with GATX's Russian airline customer.

Earnings Snapshots

Within the broader Transportation sector, J.B. Hunt Transport Services JBHT, CSX Corporation CSX and United Airlines UAL recently reported first-quarter 2022 results.

J.B. Hunt reported better-than-expected first-quarter 2022 earnings numbers. Quarterly earnings of $2.29 per share surpassed the Zacks Consensus Estimate of $1.91. The bottom line surged 67.2% year over year on the back of higher revenues across all segments.

Total operating revenues of $3,488.6 million also outperformed the Zacks Consensus Estimate of $3,260.5 million. The top line jumped 33.3% year over year. JBHT currently carries a Zacks Rank #3 (Hold).

CSX Corp’s first-quarter 2022 earnings of 39 cents per share beat the Zacks Consensus Estimate by a penny despite the decrease in overall volumes as supply-chain issues continue to dent results. The bottom line improved 25.81% year over year owing to higher revenues, aided by increased shipping rates.

Total revenues of $3,413 million outperformed the Zacks Consensus Estimate of $3291.2 million. The top line increased 21.33% year over year. CSX carries a Zacks Rank of 3 at present.

United Airlines incurred a loss of $4.24 per share in the first quarter of 2022, wider than the Zacks Consensus Estimate of a loss of $4.19. This is the ninth consecutive quarterly loss incurred by UAL as coronavirus concerns continue to weigh on air-travel demand.

Operating revenues of $7,566 million also fell short of the Zacks Consensus Estimate of $7,657.2 million. UAL is presently Zacks #3 Ranked.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GATX Corporation (GATX) : Free Stock Analysis Report

CSX Corporation (CSX) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research