GBP/USD Daily Forecast – Sterling Recovers on Positive UK PMI Report

Purchasing managers in the UK showed optimism post-election with survey data continuing to point to an economic expansion.

While the upward momentum in the services sector eased this month, manufacturing output accelerated to a 10 month high. As a result, the composite index held at 53.3, unchanged from the prior month.

Tim Moore, Associate Director at IHS Markit commented that while the PMI data is encouraging, the latest survey data highlighted concerns that stem from the Coronavirus. Service providers reported reduced tourist-related bookings and cancellations from some overseas markets. Manufacturers dealt with supply shortages from China and a sharp decline in delivery times.

Economic data from the United Kingdom has been positive this week although has failed to keep the exchange rate from declining. Earlier in the week, retail sales was reported to rise 0.9% in January after falling in the prior three months. The consumer price index rebounded sharply higher last month to levels not seen since the summer.

GBP/USD briefly declined to a nearly three-month low yesterday but has since recovered to entirely erase Thursday’s loss. Nevertheless, for the week thus far, the pair is down nearly 1%, wiping out last week’s gain.

Later in the North American session, US housing and PMI data will be released and two Fed members will be speaking.

Technical Analysis

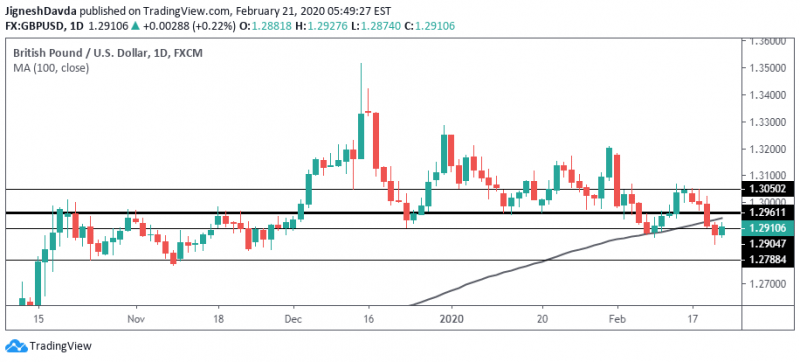

Recent price action in GBP/USD and the dollar index suggests the pair is in the process of reversing trends after a notable rally in the second half of 2019.

Economic data has been positive which has underpinned the exchange rate somewhat. Especially compared to other major currency pairs, such as EUR/USD, which trades at lows not seen in nearly three years.

On a weekly chart, the pound to dollar exchange rate has held below its 200 moving average which currently falls at 1.3033. This area will be important for the exchange rate on any recovery attempts over the next week or two.

The smaller time frames show somewhat of a mixed signal. GBP/USD is on pace to post a reversal daily chart if it manages to hold on to early-day gains, which could set up a further recovery early next week.

There is a major resistance level that falls at 1.2961 and near-term price action in relation to the level should be important. This price point held the exchange rate higher last month and was a major hurdle for most of the fourth-quarter. The 100-day moving average is currently converging towards the level to create a confluence.

Bottom Line

GBP/USD has advanced in the early day after posting losses every day in the week thus far.

The technical outlook suggests that sellers will continue taking advantage of near-term rallies even though data from the UK has been positive as of late.

This article was originally posted on FX Empire