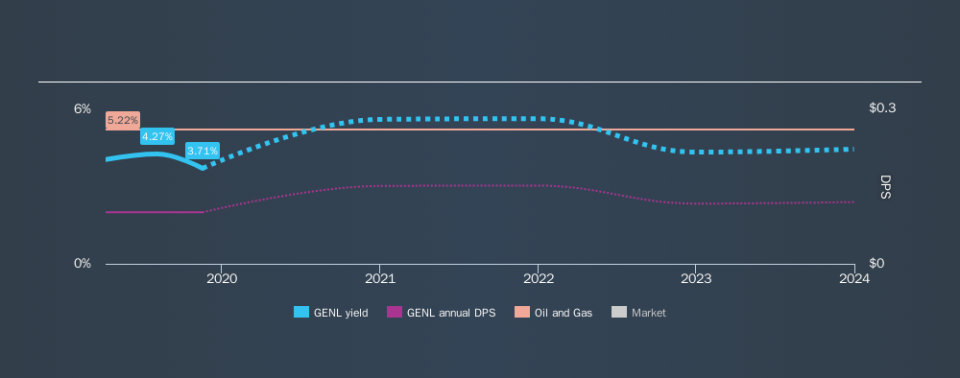

Is Genel Energy plc's (LON:GENL) 3.7% Dividend Worth Your Time?

Is Genel Energy plc (LON:GENL) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

Some readers mightn't know much about Genel Energy's 3.7% dividend, as it has only been paying distributions for a year or so. The company also returned around 1.2% of its market capitalisation to shareholders in the form of stock buybacks over the past year. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Genel Energy!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. While Genel Energy pays a dividend, it reported a loss over the last year. When a company is loss-making, we next need to check to see if its cash flows can support the dividend.

Genel Energy's cash payout ratio last year was 15%. Cash flows are typically lumpy, but this looks like an appropriately conservative payout.

While the above analysis focuses on dividends relative to a company's earnings, we do note Genel Energy's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on Genel Energy's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. With a payment history of less than 2 years, we think it's a bit too soon to think about living on the income from its dividend. Its most recent annual dividend was US$0.10 per share.

We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. It's good to see Genel Energy has been growing its earnings per share at 12% a year over the past five years. Earnings per share have been growing at a good rate, and the company is paying less than half its earnings as dividends. We generally think this is an attractive combination, as it permits further reinvestment in the business.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're not keen on the fact that Genel Energy paid dividends despite reporting a loss over the past year, although fortunately its dividend was covered by cash flow. Next, earnings growth has been good, but unfortunately the company has not been paying dividends as long as we'd like. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Genel Energy out there.

Earnings growth generally bodes well for the future value of company dividend payments. See if the 7 Genel Energy analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.