Is Generac Holdings Inc. (GNRC) A Good Stock To Buy?

You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

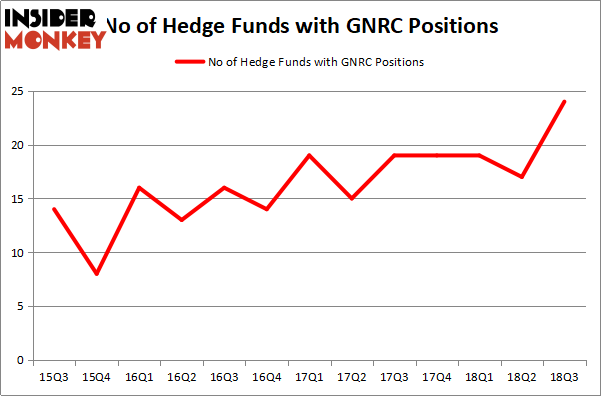

Generac Holdings Inc. (NYSE:GNRC) investors should pay attention to an increase in support from the world's most elite money managers in recent months. Our calculations also showed that GNRC isn't among the 30 most popular stocks among hedge funds.

Hedge funds' reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn't keep up with the unhedged returns of the market indices. Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We're going to take a glance at the key hedge fund action encompassing Generac Holdings Inc. (NYSE:GNRC).

How have hedgies been trading Generac Holdings Inc. (NYSE:GNRC)?

Heading into the fourth quarter of 2018, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 41% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards GNRC over the last 13 quarters. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Ian Simm's Impax Asset Management has the most valuable position in Generac Holdings Inc. (NYSE:GNRC), worth close to $65.1 million, accounting for 0.9% of its total 13F portfolio. The second most bullish fund manager is Noam Gottesman of GLG Partners, with a $17.3 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining peers that hold long positions contain Gilchrist Berg's Water Street Capital, Peter Rathjens, Bruce Clarke and John Campbell's Arrowstreet Capital and Lee Ainslie's Maverick Capital.

As aggregate interest increased, key money managers were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, assembled the biggest position in Generac Holdings Inc. (NYSE:GNRC). Arrowstreet Capital had $11 million invested in the company at the end of the quarter. Eduardo Abush's Waterfront Capital Partners also made a $4.5 million investment in the stock during the quarter. The other funds with brand new GNRC positions are Richard Driehaus's Driehaus Capital, D. E. Shaw's D E Shaw, and Bruce Kovner's Caxton Associates LP.

Let's also examine hedge fund activity in other stocks similar to Generac Holdings Inc. (NYSE:GNRC). These stocks are PolyOne Corporation (NYSE:POL), CNO Financial Group Inc (NYSE:CNO), Crescent Point Energy Corp (NYSE:CPG), and CVR Energy, Inc. (NYSE:CVI). This group of stocks' market values are closest to GNRC's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position POL,15,58503,0 CNO,14,143832,-3 CPG,12,61886,0 CVI,21,3056087,3 Average,15.5,830077,0 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $830 million. That figure was $167 million in GNRC's case. CVR Energy, Inc. (NYSE:CVI) is the most popular stock in this table. On the other hand Crescent Point Energy Corp (NYSE:CPG) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Generac Holdings Inc. (NYSE:GNRC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index