General Dynamics (GD) Q2 Earnings Top, Revenues Fall Y/Y

General Dynamics Corporation GD reported second-quarter 2022 earnings per share (EPS) of $2.75, which beat the Zacks Consensus Estimate of $2.72 by 1.1%. Quarterly earnings increased 5.4% from $2.61 per share in the year-ago quarter.

Total Revenues

General Dynamics’ second-quarter revenues of $9,189 million missed the Zacks Consensus Estimate of $9,388 million by 2.1%. Revenues slipped 0.3% from the year-ago quarter.

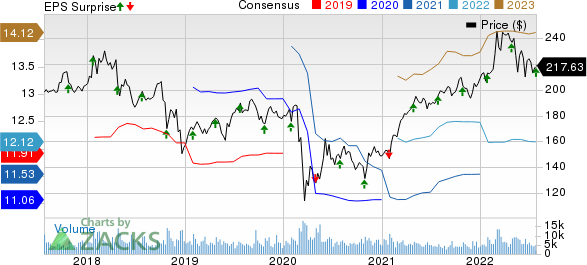

General Dynamics Corporation Price, Consensus and EPS Surprise

General Dynamics Corporation price-consensus-eps-surprise-chart | General Dynamics Corporation Quote

Segmental Performance

Aerospace: The segment reported revenues of $1,867 million, up 15.1% year over year. Operating earnings of $238 million increased 22.1% from the prior-year quarter’s $220 million.

Marine Systems: This segment’s revenues rose 4.5% from the prior-year quarter to $2,651 million. Operating earnings were up 0.5% from the year-ago quarter to $211 million.

Technologies: The segment’s reported revenues of $3,005 million decreased 5% year over year. Operating earnings of $304 million dropped 1.3% from the prior-year quarter’s $306 million.

Combat Systems: The segment’s revenues of $1,666 million were down 12.3% from the year-ago quarter’s $1,899 million. Operating earnings also declined 7.9% year over year to $245 million.

Operational Highlights

For the reported quarter, GD’s operating margin expanded 20 basis points from the year-ago quarter’s reported figure to 10.6%.

For the quarter under review, General Dynamics’ operating costs and expenses went down 0.6% from the year-ago period to $8,211 million.

Interest expenses for the reported quarter declined 12.8% year over year to $95 million.

Backlog

General Dynamics recorded a total backlog of $87.63 billion, up 0.5% from first-quarter 2022’s backlog of $87.23 billion . The funded backlog at second-quarter end was $67.89 billion.

Financial Condition

As of Jul 3, 2022, General Dynamics’ cash and cash equivalents were $2,223 million compared with $1,603 million as of Dec 31, 2021.

Long-term debt as of Jul 3, 2022 was $9,741 million, down from the 2021-end level of $10,490 million.

As of Jul 3, 2022, GD generated cash from operating activities of $2,627 million, up from $1,118 million generated in the year-ago period.

Zacks Rank

General Dynamics currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Recent Defense Releases

Lockheed Martin Corporation LMT reported second-quarter 2022 earnings of $6.32 per share, which surpassed the Zacks Consensus Estimate of $6.29 by 0.5%. The bottom line however declined 1.6% year over year.

The company’s net sales amounted to $15.45 billion, which missed the Zacks Consensus Estimate of $16.16 billion by 4.4%. The top line also declined 9.3% from $17.03 billion reported in the year-ago quarter.

Hexcel Corporation HXL reported second-quarter 2022 adjusted earnings of 33 cents per share, which exceeded the Zacks Consensus Estimate of 30 cents by 10%.

The company’s net sales totaled $393 million, which beat the Zacks Consensus Estimate of $383 million by 2.6%. Moreover, the top line witnessed an improvement of 22.7% from the year-ago quarter’s $320.3 million.

AAR Corp. AIR reported fourth-quarter fiscal 2022 adjusted earnings of 72 cents per share, which surpassed the Zacks Consensus Estimate of 68 cents by 5.9%. Earnings recorded a solid surge of 53.2% from the year-ago quarter.

In the quarter under review, AAR generated net sales worth $476.1 million. The reported figure surpassed the Zacks Consensus Estimate of $468 million by 1.7% and also improved 8.8% from $437.6 million recorded in the year-ago quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

AAR Corp. (AIR) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research