General Electric (GE) to Post Q2 Earnings: What's in Store?

General Electric Company GE is scheduled to report second-quarter 2022 results on Jul 26, before market open.

The Zacks Consensus Estimate for GE’s second-quarter earnings has been revised 46.4% downward in the past 90 days. However, GE has an impressive surprise history, with its earnings having outperformed the Zacks Consensus Estimate in each of the trailing four quarters, the average being 34.1%.

Let’s see how things are shaping up for General Electric this earnings season.

Key Factors and Estimates for Q2

General Electric is expected to have benefited from product innovation and expansion in its digital business during the second quarter. However, headwinds related to supply-chain constraints and inflationary pressure are likely to have adversely impacted its performance in the quarter. Given its strong international presence, foreign currency woes might have hurt GE’s top line.

A brief discussion on General Electric’s segments is provided below:

The Healthcare segment’s revenues are likely to have been driven by product introductions and commercial efforts. The Zacks Consensus Estimate for Healthcare revenues stands at $4,486 million, implying a nearly 1% increase from the prior-year reported figure.

For the Aviation segment, strength in the commercial market is likely to have aided performance in the second quarter. The Zacks Consensus Estimate for the segment’s revenues is pegged at $5,914 million, indicating a 22.2% increase from the year-ago period’s reported figure.

The Renewable Energy might have been hurt by weakness in Onshore Wind revenues and softness in Grid as was the case in the previous quarter. Weakness in Gas Power and Steam Power due to lower shipment volumes is likely to have affected the Power segment’s performance.

The Zack Consensus Estimate for General Electric’s earnings for the second quarter is pegged at 37 cents, suggesting a decline of 7.5% from the year-ago period’s reported figure. The consensus estimate for revenues of $17,958 million suggests a 1.8% decline from the year-ago quarter’s reported figure.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for General Electric this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But this is not the case here, as you will see below.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: General Electric has an Earnings ESP of -41.22%, as the Most Accurate Estimate of 22 cents is below the Zacks Consensus Estimate of 37 cents.

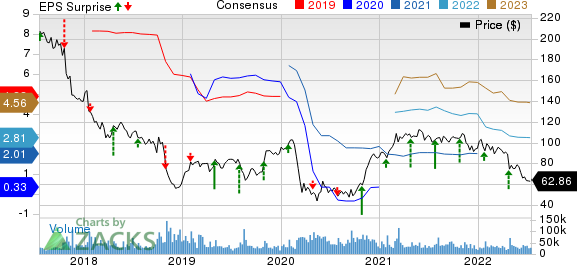

General Electric Company Price, Consensus and EPS Surprise

General Electric Company price-consensus-eps-surprise-chart | General Electric Company Quote

Zacks Rank: General Electric currently carries a Zacks Rank #4 (Sell).

Highlights of Q1 Earnings

General Electric’s quarterly earnings beat the consensus estimate by 20%. Sales lagged estimates by 2.4%. Its adjusted earnings were 24 cents per share in the first quarter, beating the Zacks Consensus Estimate of 20 cents. The bottom line matched the year-ago figure. However, GE’s consolidated revenues were $17,040 million, reflecting a year-over-year decline of 0.2%.

Stocks to Consider

Here are some companies worth considering, as according to our model, these have the right combination of elements to beat on earnings this reporting cycle.

MRC Global Inc. MRC has an Earnings ESP of +30.27% and a Zacks Rank of 1. MRC is slated to release second-quarter 2022 financial numbers on Aug 8.

In the past 60 days, MRC’s earnings estimates have increased 13.6% for the second quarter of 2022. MRC Global’s earnings surpassed the Zacks Consensus Estimate in each of the preceding four quarters, the average being 140.8%.

Crane Holdings CR has an Earnings ESP of +6.98% and a Zacks Rank #2. CR is slated to release second-quarter 2022 financial numbers on Jul 25.

In the past 60 days, CR’s earnings estimates have increased 4.1% for the second quarter of 2022. Crane Holdings’ earnings surpassed the Zacks Consensus Estimate in each of the preceding four quarters, the average being 22.2%.

Zebra Technologies ZBRA has an Earnings ESP of +2.15% and a Zacks Rank #3. ZBRA is scheduled to release second-quarter 2022 earnings numbers on Aug 2.

In the past 60 days, ZBRA’s earnings estimates have been unchanged for the second quarter of 2022. Zebra Technologies’ earnings trumped the Zacks Consensus Estimate in each of the trailing four quarters, the average being 8.8%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

MRC Global Inc. (MRC) : Free Stock Analysis Report

Crane Holdings, Co. (CR) : Free Stock Analysis Report

Zebra Technologies Corporation (ZBRA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research