General Electric (GE) Q1 Earnings Top Estimates, Revenues Miss

General Electric Company GE reported mixed first-quarter 2022 results, wherein earnings surpassed the Zacks Consensus Estimate, but sales missed the same. The company’s quarterly earnings beat the consensus estimate by 20%. Sales lagged estimates by 2.4%.

The industrial conglomerate’s adjusted earnings were 24 cents per share in the first quarter, beating the Zacks Consensus Estimate of 20 cents. The bottom line matched the year-ago figure.

Revenue Details

In the quarter under review, General Electric’s consolidated revenues were $17,040 million, reflecting a year-over-year decline of 0.2%. The quarterly sales suffered from weakness in the Power and Renewable Energy segments. A gain in Healthcare and Aviation was a relief.

The company’s top line lagged the Zacks Consensus Estimate of $17,462 million.

The performance of Aviation, Healthcare, Renewable Energy and Power is discussed below:

Aviation revenues increased 12% year over year to $5,603 million and orders grew 31%. Organically, growth rates for revenues and orders were 12% and 32%, respectively. The high volume of shop visits significantly benefited Commercial Services revenues, partially offset by a decline in Commercial Engines revenues due to supply chain constraints.

Healthcare revenues in the reported quarter totaled $4,363 million, increasing 1% year over year. The segment’s orders grew 8% on an organic basis. The segment gained from a 3% increase in services organic sales while equipment revenues were flat. Supply shortages in the industry played spoilsport in the quarter.

Renewable Energy revenues totaled $2,871 million, down 12% year over year. Organically, the segment’s sales were down 10%. Its orders decreased 21% in the reported quarter. Weakness in Onshore Wind revenues and softness in Grid adversely impacted the segment’s performance. Growth in services revenues was a relief.

The Power segment’s revenues were down 11% year over year at $3,501 million. Organically, sales decreased 6%. However, the segment’s orders increased 14% year over year (or were up 19% organically). The segment suffered due to lower shipment volumes.

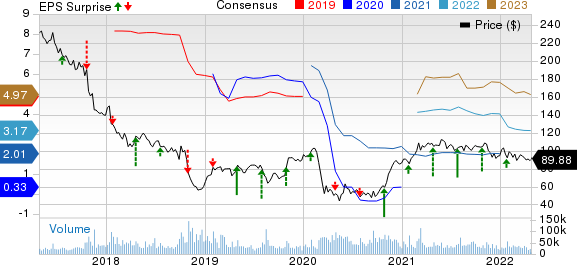

General Electric Company Price, Consensus and EPS Surprise

General Electric Company price-consensus-eps-surprise-chart | General Electric Company Quote

Margin Profile

In the quarter under review, General Electric’s cost of sales was down 0.7% year over year to $12,453 million. It represented 73% of the quarter’s revenues versus 73.4% in the year-ago quarter. Selling, general and administrative expenses decreased 26.2% to $3,651 million. It was 21.4% of the quarter’s revenues versus 17% in the year-ago quarter. Research and development expenses totaled $641 million, reflecting an increase of 14.3%. It represented 3.8% of the quarter’s revenues versus 3.3% in the year-ago quarter.

The company’s adjusted operating profit was $946 million, up 19% year over year. Margin in the quarter was 5.8%, up 90 basis points (bps).

On a reported basis, the Power segment recorded operating earnings of $63 million against a loss of $87 million in the year-ago quarter. Renewable Energy recorded a loss of $434 million compared with a loss of $234 million in first-quarter 2021. The Aviation segment’s earnings were $908 million versus $641 million in the year-ago quarter. The Healthcare segment’s profits decreased 23% to $538 million.

Interest and other financial charges decreased 19.6% year over year to $390 million.

Balance Sheet and Cash Flow

Exiting the first quarter of 2022, General Electric had cash and cash equivalents of $12.8 billion, down from $15.8 billion recorded at the end of the previous quarter. Borrowings were $28.6 billion, down from $30.8 billion at the end of the previous quarter.

Non-GAAP free cash outflow totaled $880 million in the first quarter compared with $3,361 million cash outflow recorded in the year-ago quarter.

Outlook

For 2022, General Electric anticipates organic revenue growth in the high-single digits on a year-over-year basis. Adjusted organic profit margin is predicted to expand 150 bps from the previous year.

Free cash flow will likely be $5.5-$6.5 billion for the year. Adjusted earnings per share for 2022 are anticipated to be $2.80-$3.50 per share, suggesting a rise from $1.71 recorded in 2021.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies are discussed below.

Griffon Corporation GFF presently sports a Zacks Rank #1 (Strong Buy). Its earnings surprise in the last four quarters was 56.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, Griffon’s earnings estimates have increased 9% for fiscal 2022 (ending September 2022). The stock has lost 14.5% in the past three months.

Alcoa Corporation AA presently sports a Zacks Rank #1. Its earnings surprise in the last four quarters was 11.5%, on average.

In the past 60 days, AA’s earnings estimates have increased 76.2% for 2022. The stock has rallied 16.1% in the past three months.

Ferguson plc FERG presently carries a Zacks Rank of 2 (Buy). FERG delivered a trailing four-quarter earnings surprise of 14.2%, on average.

Earnings estimates of Ferguson have increased 7% for fiscal 2022 (ending July 2022) in the past 60 days. FERG’s shares have declined 14.2% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Alcoa (AA) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

Wolseley PLC (FERG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research