General Electric (NYSE:GE) Seems Stuck in a Restructuring Cycle

This article first appeared on Simply Wall St News.

After a promising start, General Electric (NYSE: GE) spent most of the last year in sideways movement as the reverse stock split in August and the announced 3-way breakup of the company in November did little to improve the sentiment.

Yet, as uncertainty about the overall market grows, turnaround stories like GE bring on increased risks.

View our latest analysis for General Electric

Q4 Earnings Results

Non-GAAP EPS: US$0.92 (beats by US$0.03)

Revenue: US$20.3b (miss by US$1.02b)

Revenue Growth: -3.5% Y/Y

Earnings per unit:

GE Aviation: US$6.1b (FY US$21.3b, -2% Y/Y)

GE Healthcare: US$4.6b (FY US$17.7, -2% Y/Y)

GE Renewable Energy: US$4.2b (FY US$15.7b, -6% Y/Y)

GE Power: US$4.7b (FY US$16.9b, -4% Y/Y)

GE Healthcare, the best performing unit, will be the first to spin off in early 2023. Meanwhile, power and renewable business will merge in a new company sometime in 2024.

The loss of $3.9b is due to accounting for debt extinguishment, as CEO Larry Culp pointed out that the company trimmed US$87b of debt in the last 3 years following reorganizations and divestitures.

However, short-term weakness comes from guidance, as GE forecasts adjusted EPS of US$2.8-3.5 vs. the street estimate of US$3.9.

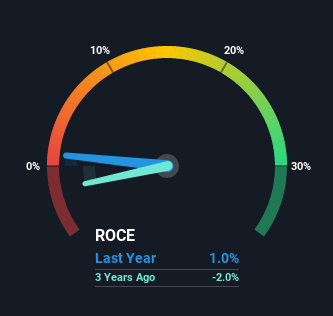

What is Return On Capital Employed (ROCE)?

To clarify, if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for General Electric:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0099 = US$1.8b ÷ (US$237b - US$58b) (Based on the trailing twelve months to September 2021).

So, General Electric has a ROCE of 1.0%. In absolute terms, that's a low return, and it also under-performs the Industrials industry average of 8.4%.

Above you can see how the current ROCE for General Electric compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering General Electric here for free.

General Electric's Consolidations Follow a Pattern

Observing the stock performance, you can spot the pattern of significant moves following prolonged periods of consolidations. While we cannot speculate about the direction, we must point out the following;

First, the market is experiencing turbulence with an increased risk of a more prominent sell-off.

Second, the ongoing consolidation has been rather long; thus, the upcoming move in either direction can be more prominent.

The trend of returns that General Electric is generating is raising some concerns. Unfortunately, returns have declined substantially over the last five years to the 1.0% we see today. On top of that, the business is utilizing 42% less capital within its operations.

The fact that both are shrinking indicates that the business is going through some tough times. Typically, companies that exhibit these characteristics don't tend to multiply over the long term because, statistically speaking, they've already gone through the growth phase of their life cycle.

In Conclusion...

While GE has done well in reducing the debt, lower returns and decreasing amounts of capital employed don't fill us with confidence. It seems that GE is struggling to gain traction as it is stuck in an endless circle of restructuring. Investors haven't taken kindly to these developments since the stock has declined 57% from five years ago.

As we approach the company's split, eventually, investors might get an opportunity to cherry-pick their position in only the best segments of the conglomerate.

On a final note, we found 3 warning signs for General Electric (1 is potentially serious) you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.