GEO Group - Too Much Pessimism Provides Opportunity

- By Praveen Chawla

The GEO Group, Inc. (NYSE:GEO) is a prison operator structured as a real estate investment trust (REIT). It describes itself as specializing in the design, financing, development and operation of secure facilities, processing centers and community re-entry centers in the United States, Australia, South Africa and the United Kingdom.

GEO's worldwide operations include the ownership and/or management of 118 facilities totaling approximately 93,000 beds, including idle facilities and projects under development, with a workforce of up to approximately 22,000. Most of its revenues and income are derived from the U.S.

GEO's stated mission is to develop public?private partnerships with government agencies around the globe providing enhanced rehabilitation and community reintegration programs for the prisoners contracted under it. GEO and CoreCivic (CXW), the two companies that manage federal prisons in the U.S., alone combine for 17 contract facilities that accommodate around 13% of the Federal Bureau of Prison's (BOP) total capacity of roughly 9,800 inmates. The BOP represents 14% of Geo's 2020 revenue.

The company's stock price has been crushed because of the recent executive order to the Federal Bureau of Prisons to not renew contracts with private prison operators going forward. Further, due to social pressures and ESG mandates, many financial institutions have stated that they will withdraw from lending money to private prison operators.

On April 7, GEO suspended its quarterly dividend payments, with the goal of maximizing the use of cash flows to repay debt, deleverage and internally fund growth, and its stock price collapsed further. It is possible that GEO may convert from an REIT to a C-Corp to navigate its current funding issues and impending non-renewals.

The following charts give the company's revenue and net operating revenue distribution, respectively.

Geo group is quite highly leveraged with debt of $9 billion and equity of only $2.1 billion. The market capitalization is only $690 million.

The following chart shows the schedule of debt payment.

$1.7 Billion of debt comes due in 2024. Therefore, GEO has about three years to figure out how to reschedule or repay this bolus of maturing debt. That will in turn depend on GEO's ability to sell or re-lease the properties which are not being renewed by the federal government.

I think the company has ample to time to sell or re-lease the properties which the BOP is not renewing. There is a good possibility the BOP ifself will buy the properties from GEO, or just rent the property and operate it itself, as it would be more economical that building a new custom facility. We will just have to wait and see how the chips fall in the quarters ahead.

Valuation

I think a good way to value the company is by the projected FCF method. The method uses a combination of six years of normalized free cash flow and 80% of book value.

It is designed for companies which have somewhat erratic cash flow from year to year. This method indicates a value of $16 a share and shows considerable margin of safety as the stock price is below $6 presently. It implies a 150% upside.

Conclusion

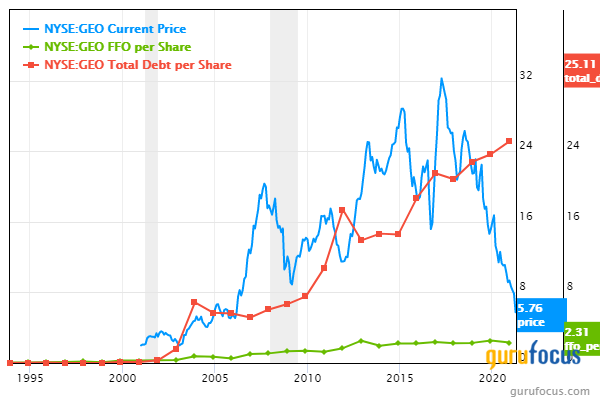

Looking at the chart below over the last 20 years, GEO has never traded at such a discount from its projected FCF value. Clearly, the stock market is expecting GEO to be at high risk of insolvency over the next three years. While that pessimitic scenario is not unreasonable, I think there is a greater chance that GEO will muddle through by selling off unneeded assets, and thus this market despondency represents an opportunity for investors with a very long term horizon and a high tolerance for risk.

Disclosure: The author owns stock of The GEO Group Inc.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.