Gibraltar (ROCK) Q2 Earnings Beat Estimates, Margin Rise

Gibraltar Industries, Inc. ROCK reported impressive results in second-quarter 2022. Earnings and net sales surpassed the Zacks Consensus Estimate and increased on a year-over-year basis, backed by a strong residential segment.

Following the results, the stock fell 2.93% on Aug 3.

Chairman and CEO of ROCK, Bill Bosway, stated, “Part of our ongoing strategy is to further simplify and digitize our businesses, and we completed two additional ERP implementations during the quarter; these systems are designed to enable us to better connect with and provide seamless value to our customers while increasing speed, flexibility, and efficiency of our operations. Demand drivers remain solid for the overall business despite our Renewables’ customers waiting for clarity on panel availability to execute orders and finalize projects.”

Inside the Headlines

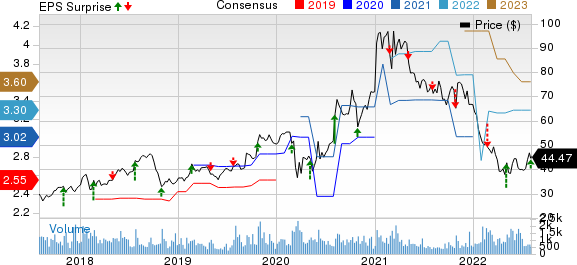

Gibraltar reported adjusted earnings of 96 cents per share, which topped the Zacks Consensus Estimate of 83 cents by 15.7% and increased 18.5% year over year.

Gibraltar Industries, Inc. Price, Consensus and EPS Surprise

Gibraltar Industries, Inc. price-consensus-eps-surprise-chart | Gibraltar Industries, Inc. Quote

Quarterly net sales of $366.9 million topped the consensus mark of $366 million by 0.3% and increased 5.3% from the prior year’s levels. On an adjusted basis, the top line increased 6.8% year over year to $364.2 million. The upside was driven by participation gains and price management in the Residential segment, partially offset by continued supply chain woes and project delays in the Agtech and Renewables segments.

The order backlog was $408 million, up 5% year over year. The upside can be attributed to robust end-market demand and new order activity across the business.

Segmental Details

Renewable Energy: Net sales in the segment decreased 5.8% from the year-ago quarter’s levels to $101.5 million. The decline was due to dynamic solar project schedules. Backlog was down 2.1% year over year as new bookings slowed pending visibility on these key trade issues.

Adjusted operating margins contracted 430 basis points (bps) year over year to 7% but improved more than 1,200 bps sequentially. Gibraltar expects sequential margin improvement in the second half of 2022. Adjusted EBITDA margin contracted 420 bps from the prior-year quarter’s levels to 9.3%.

Residential Products: Net sales in the segment increased 21.9% year over year to $200.2 million, marking the eighth consecutive quarter of double-digit growth. The uptick can be attributed to price management and participation gains. Adjusted operating margins of 18.5% improved 190 bps in the quarter, thanks to price/cost management, supply chain initiatives, labor management, and additional 80/20 initiatives. Adjusted EBITDA margin improved 150 bps from the prior-year quarter’s levels to 19.6%.

Agtech: Sales declined 18.6% year over year to $43.7 million and adjusted sales fell 11.9% to $40.9 million. The downside was due to the shift of the Produce and Cannabis project into the third and fourth quarters of 2022. Backlogs were up 30% from the year-ago quarter’s levels, backed by strong quote activity and new order bookings. Adjusted operating margins improved 80 bps year over year to 6.7%. Adjusted EBITDA margin was up 100 bps year over year to 9.4%.

Infrastructure: Sales in the segment fell 5.3% year over year to $21.5 million. Although order backlog remained flat year over year, bidding activity continued to be very strong and new bookings accelerated early in the third quarter. The company expects the infrastructure bill to have a positive impact later in the second half of 2022.

Adjusted operating margins dropped 500 bps year over year due to unfavorable product mix but rose 690 bps to 13.4% sequentially, as the business overcomes steel inflation. Margins will likely improve in the rest of 2022 with lower margin projects subsiding, business mix improving, and volume leverage. Adjusted EBITDA margin contracted 460 bps from the prior-year quarter’s tally to 17.3%.

Costs & Margins

In the reported quarter, selling, general and administrative expenses increased 1.2% year over year to $50.1 million. As a percentage of sales, the metric improved 50 bps year over year to 13.7%.

Adjusted operating margin expanded 130 bps year over year to 11.8%. Adjusted EBITDA margin also improved 110 bps from the prior year to 14.2%.

Balance Sheet & Cash Flow

As of Jun 30, 2022, Gibraltar had cash and cash equivalents worth $17.1 million compared with $12.8 million at the 2021-end. Long-term debt was $93.5 million, down from $23.8 million a year ago.

In first-half 2022, net cash provided by operating activities totaled $0.54 million compared with $10.78 million in the previous year.

2022 Guidance Maintained

Gibraltar expects revenues to be $1.38-$1.43 billion, suggesting year-over-year growth of 3-6.7%. Adjusted earnings are likely to be in the range of $3.20-$3.40 per share, indicating a 15.1-22.3% year-over-year rise.

Zacks Rank & Peer Releases

Gibraltar currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

United Rentals, Inc. URI reported better-than-expected second-quarter 2022 results. Better fleet productivity on broad-based rental demand in construction and industrial verticals, higher total and rental revenues along with stronger pricing helped the company to boost profit.

URI also lifted its full-year guidance for total revenues, adjusted EBITDA and free cash flow, given broad-based end-market activity, contractor backlogs, customer sentiment and our visibility through the balance of the year.

Owens Corning OC reported solid second-quarter 2022 results. Its earnings and net sales surpassed their respective Zacks Consensus Estimate and increased on a year-over-year basis.

OC’s solid quarterly results were backed by strong demand across the markets served, structural improvements and strategic investments.

TopBuild Corp. BLD reported stellar results for second-quarter 2022. Its earnings and revenues surpassed their respective Zacks Consensus Estimate and improved majorly on a year-over-year basis.

Strong demand, coupled with its ongoing focus on managing price, achieving operational efficiency improvements, and leveraging fixed costs, drove the BLD’s results.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gibraltar Industries, Inc. (ROCK) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research