Global Companion Animal Rehabilitation Services Market to 2030: Rise in Number of Veterinary Rehabilitators Drives Growth

Global Companion Animal Rehabilitation Services Market

Dublin, May 29, 2023 (GLOBE NEWSWIRE) -- The "Companion Animal Rehabilitation Services Market Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats, Others), By Therapy Type, By Indication, By End-use (Veterinary Rehab Centers & Hospitals) By Region, And Segment Forecasts, 2023 - 2030" report has been added to ResearchAndMarkets.com's offering.

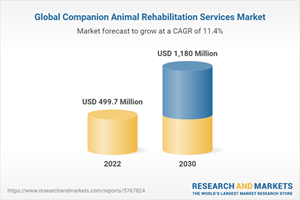

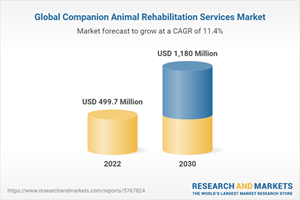

The global companion animal rehabilitation services market size is expected to reach USD 1.18 Billion by 2030 to expand at a CAGR of 11.42% from 2023 to 2030.

The rise in number of veterinary rehabilitators, growing prevalence of orthopedic and musculoskeletal problems in pet animals, significant pet ownership rates, rising pet humanization trends, and increased awareness among pet parents regarding the advantages of drug-free and non-invasive rehabilitation treatments are some of the factors driving the market growth.

Rehabilitation services are highly considered for companion animals to provide them numerous benefits such as improved coordination & balance, increased range of motion, increased muscle strength, weight loss for obese pets, and reduced pain or inflammation post-surgery, among others. The major goal of physical rehabilitation in pet cats and dogs is to speed healing, decrease pain or discomfort, and improve their well-being. Several pet care centers are offering advanced rehab services with a wide range of programs, to aid animals to recover from injury, chronic diseases, and surgery.

Pet rehabilitation therapies have evolved in the past few years, from being a niche service to becoming a popular veterinary treatment option. It utilizes a range of non-invasive techniques to improve pets' overall health and mobility with directed exercises. Due to its growing availability & awareness in both developed & emerging economies, rehabilitation services are offered significantly in animals similar to humans.

Dogs and horses involved in sporting activities are widely known to be benefited from rehabilitation services with high patient compliance. Although pet rehabilitation therapies have been in the industry for a longer time, the demand has recently increased due to its advancing treatments, independently or together with several other therapies, to maximize the benefits.

As per an article published in February 2022 by the College of Veterinary Medicines in the U.S., over half of the total pet population in the country is estimated to be geriatric. A sizeable portion of these animals is considered to have mobility issues and other chronic conditions like arthritis as they reach the end of their expected lifespan.

Therefore, most pet parents prefer the option of rehabilitation when their senior pets start to become a little stiffer while moving around or getting up. According to The Valley Animal Rehabilitation, elderly pets are more prone to gain weight owing to their low mobility, thereby leading to obesity, heart problems, or diabetes. Rehab techniques such as hydrotherapy can help animals lose weight and prevent such deadly conditions at early stages.

The market was negatively impacted during the COVID-19 pandemic owing to the closure of rehab centers with limited access to pet care. The announcement of nationwide lockdowns and movement restrictions led pet rehabilitators and animal owners to face obstacles in obtaining non-invasive therapies during the year 2020. However, the market quickly recovered in the following year with ease of restrictions coupled with increased pet adoption & ownership rates.

Additionally, the market for companion animal rehabilitation services is further propelled by the large presence of pet physical therapy centers in developed regions. For instance, Beach Animal Rehabilitation Center in the U.S. offers top-rated rehabilitation therapies such as underwater or ground treadmills, acupuncture, and guided exercises for cats and dogs. Similarly, several other players in the market are striving to enhance the well-being of companion animals, benefiting from a pain-free life.

Companion Animal Rehabilitation Services Market Report Highlights

Based on the animal type segment, dogs held a dominant market share of more than 55% in 2022 and is expected to grow efficiently over the forecast period, owing to the increased ownership rate of dogs and rising canine rehabilitator centers.

Based on therapy type, the therapeutic exercises segment dominates the market over the forecast period. Due to its benefits, such as providing comfort, reducing pain or inflammation, improving motor skills, enhancing muscle strength, and others.

Based on indication, the post-surgery segment dominated the market with a share of over 30% in 2022, owing to rising surgery rates in companion animals for orthopedic or musculoskeletal conditions.

Based on the end-use segment, the veterinary rehab centers & hospitals held the largest market share of over 45% in 2022. The rescue & shelter homes segment is expected to grow at the fastest CAGR over the forecast period.

North America is expected to dominate the companion animal rehabilitation services market throughout the projected period owing to the region's large pet care expenditure and pet population.

Key Attributes:

Report Attribute | Details |

No. of Pages | 130 |

Forecast Period | 2022 - 2030 |

Estimated Market Value (USD) in 2022 | $499.7 Million |

Forecasted Market Value (USD) by 2030 | $1180 Million |

Compound Annual Growth Rate | 11.4% |

Regions Covered | Global |

Key Topics Covered:

Chapter 1 Methodology and Scope

Chapter 2 Executive Summary

Chapter 3 Companion Animal Rehabilitation Services Market Variables, Trends & Scope

3.1 Market Lineage Outlook

3.1.1 Parent Market Analysis

3.1.2 Ancillary Market Analysis

3.2 Market Dynamics

3.2.1 Market Driver Analysis

3.2.2 Market Restraint Analysis

3.3 Industry Analysis

3.4 Regulatory Framework

3.5. Estimated Animal Population By Region & Key Countries

3.6. Opportunity Analysis/Unmet Needs

3.7 Covid-19 Impact Analysis

3.7.1 Current And Future Impact Analysis

3.7.2 Impact Of Covid-19 On Rehabilitation Centers

Chapter 4 Animal Type Estimates & Trend Analysis, 2018 - 2030 (USD Million)

4.1 Animal Type Movement Analysis, 2018 - 2030 (USD Million)

4.2 Companion Animal Rehabilitation Services Market Share Analysis, 2022 & 2030

4.3 Dogs

4.3.1 Dogs Market Estimates And Forecasts, 2018 - 2030 (USD Million)

4.4 Cats

4.4.1 Cats Market Estimates And Forecasts, 2018 - 2030 (USD Million)

4.5 Others

4.5.1 Others Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Chapter 5 Therapy Type Estimates & Trend Analysis, 2018 - 2030 (USD Million)

5.1 Therapy Type Movement Analysis, 2018 - 2030 (USD Million)

5.2 Companion Animal Rehabilitation Services Market Share Analysis, 2022 & 2030

5.3 Therapeutic Exercises

5.3.1 Therapeutic Exercises Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.4 Manual Therapy

5.4.1 Manual Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.5 Hydrotherapy

5.5.1 Hydrotherapy Animal Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.6 Hot & Cold Therapies

5.6.1 Hot & Cold Therapies Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.7 Electro Therapies

5.7.1 Electro Therapies Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.8 Acupuncture

5.8.1 Acupuncture Animal Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.9 Shockwave Therapy

5.9.1 Shockwave Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.10 Other Therapies

5.10.1 Other Therapies Animal Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Chapter 6 Indication Estimates & Trend Analysis, 2018 - 2030 (USD Million)

6.1 Indication Movement Analysis, 2018 - 2030 (USD Million)

6.2 Companion Animal Rehabilitation Services Market Share Analysis, 2022 & 2030

6.3 Post-Surgery

6.3.1 Post-Surgery Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.4 Traumatic Injuries

6.4.1 Traumatic Injuries Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.5 Acute & Chronic Diseases

6.5.1 Acute & Chronic Diseases Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.6 Developmental Abnormality

6.6.1 Developmental Abnormality Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.7 Other Indications

6.7.1 Others Indications Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Chapter 7 End-Use Estimates & Trend Analysis, 2018 - 2030 (USD Million)

7.1 End-Use Movement Analysis, 2018 - 2030 (USD Million)

7.2 Companion Animal Rehabilitation Services Market Share Analysis, 2022 & 2030

7.3 Veterinary Rehab Centers & Hospitals

7.3.1 Veterinary Rehab Centers & Hospitals Market Estimates And Forecasts, 2018 - 2030 (USD Million)

7.4 Rescue & Shelter Homes

7.4.1 Rescue & Shelter Homes Market Estimates And Forecasts, 2018 - 2030 (USD Million)

7.5 Others

7.5.1 Others Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Chapter 8 Regional Estimates & Trend Analysis, 2018 - 2030 (USD Million)

Chapter 9 Key Rehab Practices Profiles

For more information about this report visit https://www.researchandmarkets.com/r/mepsa2

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900