Gold Down, Yen Up, US Dollar Sideways Ahead of Fed - Caution Advised

ASIA/EUROPE FOREX NEWS WRAP

The day we’ve been waiting for has finally arrived. Ever since May 22, when Fed Chairman Ben Bernanke said that the Fed could wind down QE3 over the course of the “next few meetings,” US economic data has been under the microscope as market participants try to figure out when the Fed’s ‘taper’ might ultimately come.

At the time Chairman Bernanke suggested that QE3 could be wound down, the Citi Economic Surprise Index suggested that recent US data had been skewed lower, with the gauge showing -19.4. By June 10, the index had dipped to -32.9, suggesting that US data had been worse than consensus forecasts. Today, the index is reading -14.8. What is the significance of these data points? They show that in the interim period between May 22 and today, data has been largely mediocre. In context of what Fed policymakers have previously said, it’s important to recognize that “The Evan’s Rule” has yet to see either of its circuit breakers hit - +2% yearly inflation or a 6.5% Unemployment Rate. The more dovish FOMC members have suggested that NFPs trending above +200K over the three-, six-, and 12-month time horizons could warrant tapering; these averages stand at +155.3K, +194.2K, and +176.3K, respectively.

Economic data aside, financial markets aren’t offering clear signals. US Treasury yields are at their highest rates in 16-months, while Gold has continued to slump towards $1300/oz. While these are “taper on” trades, the fact that the S&P 500 is within 2.5% of all-time nominal highs (1687) and the USDJPY is sitting near two-month lows suggests that QE3 is here to stay. This divergence highlights the fact that someone is wrong. Today’s Fed meeting will thus provoke a violent response in markets, and FX is very vulnerable right now. Absent strong conviction, it may be best to sit on the sidelines for this momentous event risk.

Taking a look at European credit, peripheral yields are mixed, but the trend of peripheral yields widening out relative to their German counterparts has continued. The Italian 2-year note yield has increased to 1.782% (+2.1-bps) while the Spanish 2-year note yield has decreased to 2.118% (-0.6-bps). Similarly, the Italian 10-year note yield has increased to 4.287% (+0.3-bps) while the Spanish 10-year note yield has decreased to 4.532% (-0.3-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 10:45 GMT

JPY: +0.20%

AUD: +0.19%

NZD: +0.15%

CAD:+0.03%

EUR:-0.03%

GBP:-0.06%

CHF:-0.12%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.12% (-0.25% prior 5-days)

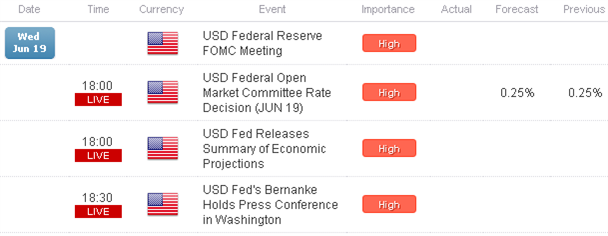

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators. Want the forecasts to appear right on your charts? Download the DailyFX News App.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: No change: “The pair has traded into Right Shoulder resistance in a potential Head & Shoulders pattern dating back to the September 2012 high (post-QE3 announcement), and the two overshoots on Wednesday and Thursday into $1.3400 have been rejected. Accordingly, a Bearish Key Reversal on the [Thursday, June 13] 4H timeframe (01:00 EDT to 05:00 EDT candle) gives an excellent reference points for shorts, as the period high coincides with the mid-January swing high at 1.3400/05. I maintain: ‘Considered in context of (1) the USDCHF failing to set a new monthly low as the EURUSD set a new monthly high today and (2) the EURJPY reversing sharply off of [¥128.00], there is evidence building that a turn may be coming.’” The grind higher continues, and with new monthly highs set after a failed swing lower, it appears that the EURUSD may be coiling now for a breakout higher – I’ve reduced my positioning by half am tentatively considering to cut entirely ahead of tomorrow’s FOMC.

USDJPY: No change: “With US Treasury yields [near] their highest level in 16-months and the USDJPY sinking, there is probably trouble ahead (I don’t think Fed begins a significant QE3 taper in June; thus yields fall as bond prices move up, weighing on USDJPY). There are two major bearish patterns in play right now: a Bearish Rising Wedge; and a Bearish Broadening Wedge. The Bearish Rising Wedge was initiated on May 30, and the measured move calls for a return to the base at 92.55. The Bearish Broadening Wedge, initiated yesterday, calls for a move back to the base near 90.84. Accordingly, in context of retail traders adding to their USDJPY longs, we find that the combination of sentiment and technicals offers a favorable opportunity for continued losses.” Of note: the USDJPY is close to breaking out of the daily RSI downtrend in place since May 17, suggesting a turn may be on the horizon.

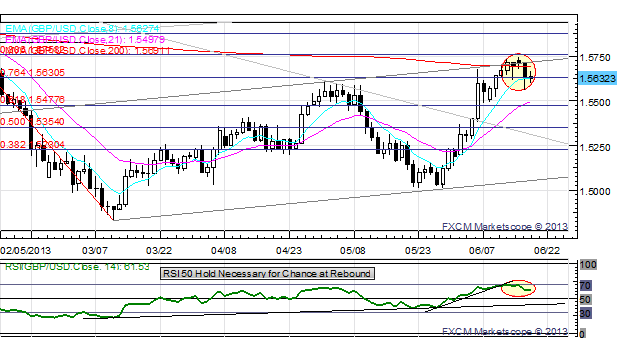

GBPUSD: Yesterday I said: “The pair is attempting to crack the 200-SMA at $1.5700 again, after several rejections last week and the week before. Once more, the GBPUSD finds itself in a state trepidation as it makes little headway above the key moving average, as the daily RSI breaks its late-May/early-June uptrend at the top rail of the ascending channel off of the March and May lows (drawn to the early-May high). In terms of daily RSI, the uptrend has broken before achieving overbought conditions, suggesting that a near-term top may be in place.” Today, price has failed dramatically above its 200-SMA, falling back to the 8-EMA for the first time since June 3. However, losses may slow at this point, as price has fallen into the late-April swing highs 1.5590/610.

AUDUSD: Yesterday I said: “The AUDUSD has failed to achieve a close above the 21-EMA since April 30 suggesting that selling pressure remains firm. Finally, with the bullish daily RSI divergence having been mostly resolved at this point in time as well, the last bout of AUDUSD strength may arrive this week.” While the AUDUSD was positive at the time of writing yesterday, failure at the 21-EMA and the 23.6% Fibonacci retracement from the April 11 high to the June 11 low at $0.9621 capped the bounce, and now the pair finds itself back in the pivotal 0.9325/410 zone, major support/resistance in November 2009, April 2010, and October 2011. Note: COT positioning remains extremely short Aussie.

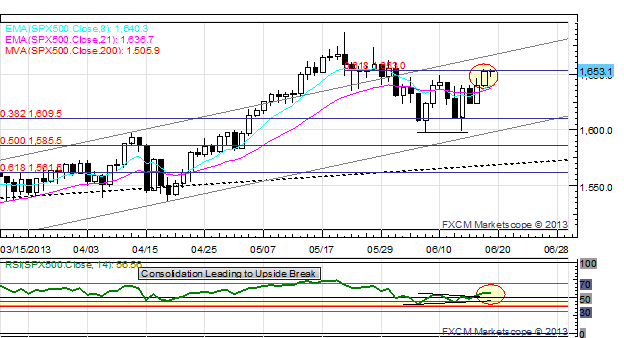

S&P 500: No change: “The S&P 500 held the 38.2% Fibonacci retracement of the late-February low to the late-May high at 1610, and is trading back to the conflux of the 8-/21-EMA at 1631/33 again – price has touched one of these two moving averages every trading session since June 7. Resistance now comes at the top of the Evening Star candle cluster that formed June 7 to June 11) at 1650. The index is also close to breaking the daily RSI downtrend, which would be supportive of further gains as well (a Symmetrical Triangle on RSI is breaking to the upside). Firm support is at 1595/1600, and a break here would lead to a sharp pullback towards 1585 and 1561.”

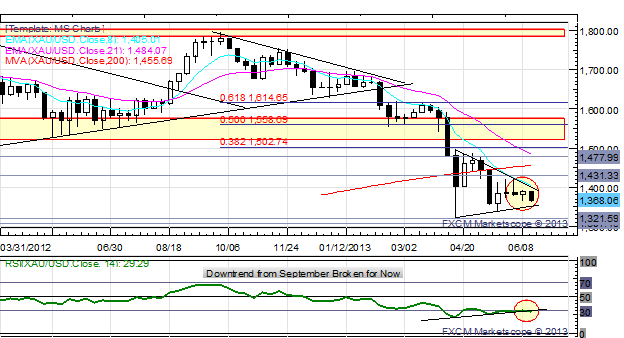

GOLD: No change: “If the US Dollar turns around, however (as many of the techs are starting to point to), then Gold will have a difficult gaining momentum higher. Indeed this has been the case, with Gold failing to reclaim the 61.8% Fibonacci retracement of the April meltdown at $1487.65, only peaking above it by 35 cents for a moment a few weeks ago.”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.