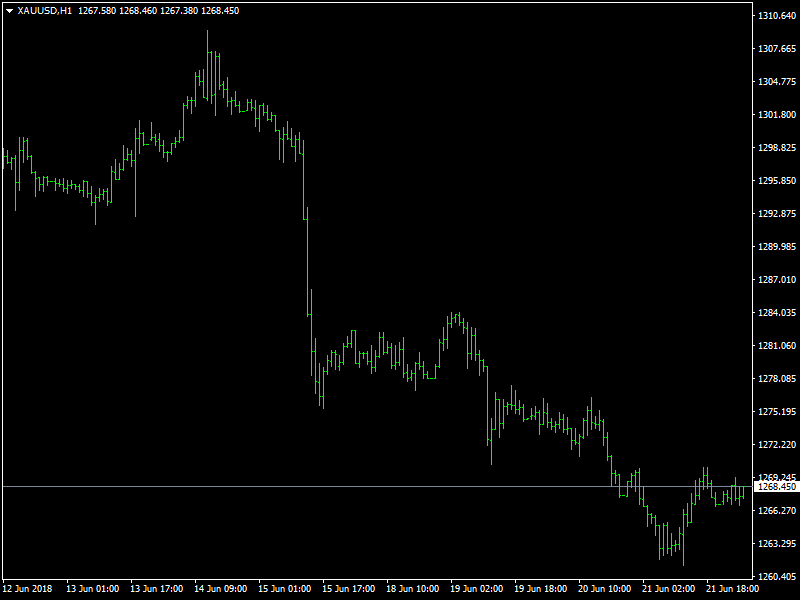

Gold Edges Up as Dollar Rally Slows Down

Gold prices inched up early on Friday after hitting a 6-month low the session before, with the dollar retreating from an 11-month peak. Spot Gold was 0.1% higher at $1,268.24 an ounce by 0057 GMT. It touched it’s lowest since Dec. 19 at $1,260.84 on Thursday. US Gold futures for August delivery were nearly unchanged at $1,270.20 per ounce. The dollar fell from an 11-month peak against a basket of major currencies as investors took profits, while sterling rebounded from a seven-month low after a slightly hawkish tilt from the Bank of England surprised the market. USD/ trade war is affecting gold for the time-being. Unless the dollar weakens significantly there would not be any major change in XAUUSD price action.

Gold Prices Recover

Asian shares were under pressure on Friday on signs that U.S. trade battles with China and many other countries are starting to chip away at corporate profits while an increasingly shrill exchange of words between the United States and China that is threatening to trigger a global trade war has claimed another victim – Germany’s auto sector. On a similar note XAGUSD (Silver) also saw slight recovery in price with the pair seeing nearly 0.3% increase in value as the pair rose to $16.38 during Asian market hours on Friday.

Crude Oil price continues to remain choppy ahead of two days OPEC and Non-OPEC members meet scheduled to begin later today. The summit will mostly focus on discussions over raising Crude Oil output to meet with supply demand created by US sanctions on Iran and Venezuela. US/China trade war proceedings also greatly affects the pair and investors await for updates from initial proceedings of the meeting before placing new bets for trading session that is set to open next week. WTIUSD is currently trading around $66.38 and is expected to remain in $66 handle as trading session closes for the week. As of now OPEC’s crunch meeting in Vienna on Friday finds the oil cartel divided after nearly two years of unity over production curbs, which were due to run until the year’s end. Saudi Arabia and Russia are leading the push to boost supplies; Iran, Iraq and Venezuela are opposed to a significant increase. A decision to spike output of crude oil by 600k BPD is agreed upon during the meeting is expected to trigger a relief rally in Crude Oil price action.

This article was originally posted on FX Empire

More From FXEMPIRE:

Natural Gas Price Prediction – Prices Slip Following Inventory Build

E-mini Dow Jones Industrial Average (YM) Futures Analysis – June 22, 2018 Forecast

Gold Price Prediction – Gold Consolidates After Dropping to New Range

USD/CAD Price Forecast – USD/CAD Finds Support above 1.325 Handle as US Greenback Slows Down

E-mini S&P 500 Index (ES) Futures Technical Analysis – June 22, 2018 Forecast