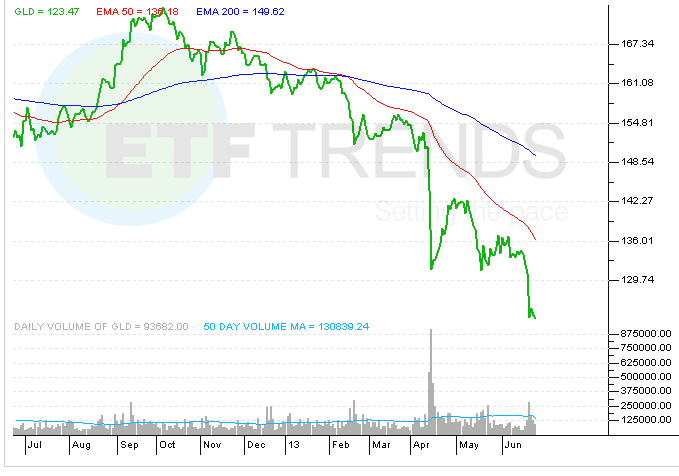

Gold ETF Still Bleeding Assets Despite Price Bounce

Redemptions at SPDR Gold Shares (GLD) continue despite the precious metal’s bounce the past week following the sharp decline.

Bullion holdings in the gold ETF fell nearly 2% on Monday to 35.5 million ounces, the lowest level since November 2009, according to Reuters.

Year to date, GLD has seen net outflows of $12.2 billion, the highest for any U.S.-listed ETF, according to IndexUniverse data.

The gold fund was down about 15% so far this year, as of Monday’s close.

GLD slipped 1% in early trading Tuesday after rising for five straight sessions. Gold prices climbed back above $1,400 an ounce.

Goldman Sachs analysts on Tuesday advised clients to close short bets against gold they had recommended earlier this month before the sell-off. [Gold Falls Amid ‘Steady, Large’ Outflows from Bullion ETFs]

“Our bias is to expect further declines in gold prices on the combination of continued ETF outflows as conviction in holding gold continues to wane as well as our economists’ forecast for a reacceleration in U.S. growth later this year,” the Goldman analysts said in a Dow Jones Newswires report.

SPDR Gold Shares

Full disclosure: Tom Lydon’s clients own GLD.

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.