Goldman Sachs BDC (GSBD) Q3 Earnings Beat, Costs Rise, Stock Up

Goldman Sachs BDC’s GSBD shares have gained 2.2% since the announcement of third-quarter 2021 results late last week. Net investment income of 63 cents per share beat the Zacks Consensus Estimate of 48 cents. This included purchase discount amortization of 15 cents per share related to its merger with Goldman Sachs Middle Market Lending Corp in October 2020.

The results benefited from a drastic improvement in total investment income. Rise in net asset value and a solid investment portfolio balance also offered support. However, an increase in operating expenses was a headwind.

Net investment income was $64.3 million, up substantially from $18.2 million in the prior-year quarter.

Total Investment Income & Expenses Surge

Total investment income was $96.7 million, jumping significantly from $31.5 million in the year-ago quarter.

Total expenses increased substantially year over year to $33.5 million. An increase in all expense components led to the rise. During the quarter, the company recorded fee waivers of $1.4 million.

The fair value of Goldman Sachs BDC’s total investment portfolio was $3.5 billion as of Sep 30, 2021, consisting of investments in 111 portfolio companies across 37 industries.

In the reported quarter, the company made new investment commitments of $670 million in new debt and equity.

Strong Balance Sheet & Liquidity Position

As of Sep 30, 2021, Goldman Sachs BDC’s net asset value was $15.92 per share compared with $15.91 on Dec 31, 2020.

As of Sep 30, 2021, the company had $1.64 billion of the total principal amount of debt outstanding. It comprised $624.9 million of outstanding borrowings under its senior secured revolving credit facility, $155 million of unsecured convertible notes and $360 million of unsecured notes due 2025, and $500 million of unsecured notes due 2026.

Also, Goldman Sachs BDC had $1.07 billion available under its senior secured revolving credit facility, and $171.6 million in cash and cash equivalents.

Our Take

Steady improvement in total investment income and strong origination volume are anticipated to support Goldman Sachs BDC. However, mounting expenses remain a major concern.

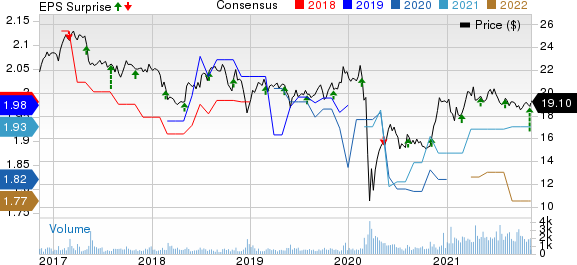

Goldman Sachs BDC, Inc. Price, Consensus and EPS Surprise

Goldman Sachs BDC, Inc. price-consensus-eps-surprise-chart | Goldman Sachs BDC, Inc. Quote

Currently, Goldman Sachs BDC carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

Hercules Capital Inc.’s HTGC third-quarter 2021 net investment income of 33 cents per share beat the Zacks Consensus Estimate by a penny. The bottom line was 2.9% down from the year-ago quarter figure.

Ares Capital Corporation’s ARCC third-quarter 2021 core earnings of 47 cents per share beat the Zacks Consensus Estimate of 45 cents. The bottom line reflected a rise of 20.5% from the prior-year quarter.

TriplePoint Venture Growth BDC Corp.’s TPVG third-quarter 2021 net investment income was 32 cents per share, missing the Zacks Consensus Estimate of 35 cents. The bottom line also declined 20% from the year-ago quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

Hercules Capital, Inc. (HTGC) : Free Stock Analysis Report

TriplePoint Venture Growth BDC Corp. (TPVG) : Free Stock Analysis Report

Goldman Sachs BDC, Inc. (GSBD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research