Goldman Sachs Stock Boasts Scary Good Seasonality in October

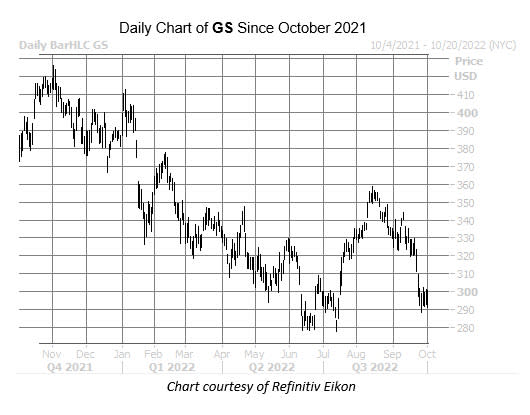

Blue-chip bank giant Goldman Sachs Group Inc (NYSE:GS) is off to a promising start this month, last seen up 2.2% at $299.48, as the market tries to brush off some of the pain felt by Wall Street in September. The security has managed to keep some distance from its current perch and its July 14 annual low of $277.84. This is thanks to a floor at the $290 region, though it hasn't been able to break out above the $301 mark since gapping below here several weeks prior. The good news is, Goldman Sachs has seasonality on its side, and could stage a breakout this month, if history is any indication.

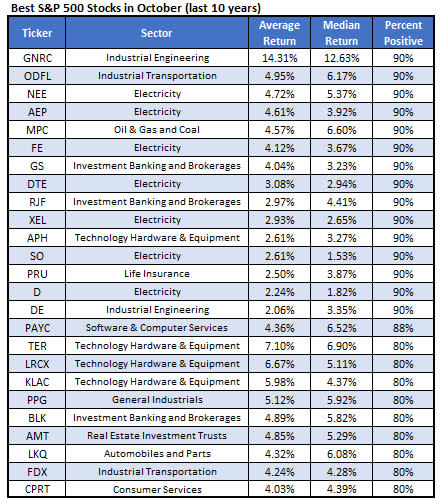

Schaeffer's Senior Quantitative Analyst Rocky White just conducted a study highlighting the 25 best performing S&P 500 Index (SPX) stocks in October, going back 10 years. According to White's data, GS has seen positive returns during nine of these years, averaging a 4% monthly pop. This makes Goldman Sachs stock the best bank stock on the list, as well as the top performing Dow member. Should GS make a similar move this month, it would put the security just below the $312 level.

The stock could be overdue for a short-term bounce, regardless. The equity's 14-day Relative Strength Index (RSI) of 19 puts in well into "oversold" territory.

An unwinding of pessimism among options traders could also be on the horizon. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), GS sports a 50-day put/call volume ratio of 1.14, which sits in the 99th percentile of its annual range. In other words, long puts have rarely been more popular during the past year.