Best Buy just delivered a gut-wrenching lesson to novice investors

Good businesses don’t necessarily make good stocks. Similarly, bad businesses don’t necessarily make bad stocks.

This may explain why Best Buy (BBY) shares are up 19% even as online retailers like Amazon.com (AMZN) continue to steal business.

One of the biggest mistakes you can make in investing is to assume that the direction of a stock price will be dictated by your current personal assessment of a business. Thinking like this is an embarrassing mistake that is almost certain to come with money-losing consequences.

Stocks are discounting mechanisms, which means current prices come with two implications: 1) they account for expectations for the future of the company, and 2) those expectations are largely guesses, which mean they could be wrong.

Let’s take Best Buy for example. We all know the story, right? Best Buy was a cool place to buy personal electronics. But then everyone learned they could buy those same electronics for cheaper on Amazon.com. Plus Amazon makes it so that you don’t ever have to leave your home.

Even more embarrassing for Best Buy, consumers will test out products at stores and then go home and order them on Amazon. In other words, Best Buy does all the salesmanship, yet collects no sales or commissions. This practice is so rampant that it has a name: show-rooming.

So, does this mean you short the stock? NO!

If everyone you ask and all of the literature you read reflect this sad and bleak assessment of the business, then it’s not unreasonable to assume that this information is priced into the market. In other words, this information won’t make you any money.

Even worse, it’s possible that sentiment is so bad that the stock is pricing in a scenario that’s likely to be far worse than what is reasonable for a struggling company. In other words, the pendulum may have swung too far in the bearish direction.

Tuesday’s double-digit gain in Best Buy shares would suggest as much. Indeed, in recent weeks we’ve seen shares go up for Wal-Mart (WMT), Macy’s (M), Kohl’s (KSS), and Nordstrom (JWN). All are among brick-and-mortar retailers that have been losing to online competition, yet all saw their shares spike after beating low expectations.

But don’t go dumping your life-savings into Best Buy

To be clear, it is very difficult to truly know what is and isn’t priced into a stock at any given time. Furthermore, it is arguably impossible to know where a stock price is headed despite all the information you may have accumulated. Who knows? Best Buy could potentially erase all of its gains today and end negative.

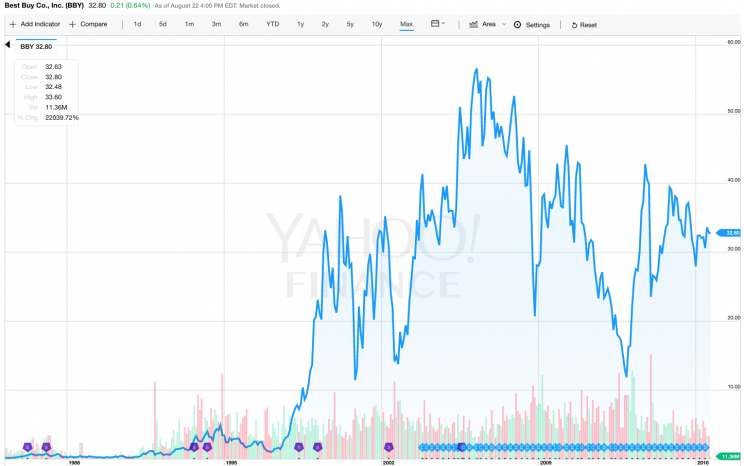

Take a look at the long-term chart of Best Buy. Can you discern a consistent story in all of those ups and downs?

Investing is hard. The market often doesn’t make sense. Most professionals who try to beat the market, don’t. And of the few who do beat the market, almost all fail to beat it again.

The point: be careful and do your homework before investing. And importantly, don’t assume that a stock price will move in the same direction as an underlying business at the same time.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Why brick-and-mortar just can’t compete with online retail

The shifting American retail landscape summarized in 3 charts

What Wall St. is saying about the all-time-high stock market