Google (GOOGL) to Invest $4B in Jio, Expand in Telecom Space

Alphabet’s GOOGL division Google reportedly plans to invest $4 billion in Jio Platforms Limited, the digital arm of a massive India-based conglomerate, Reliance Industries (RIL).

Jio has emerged as the number one telecom operator in India, both in terms of traffic and revenues, despite stiff competition from Bharti Airtel.

The latest deal highlights Google’s growing interest in the telecom space of India.

Moreover, the move will aid the search giant’s competitive position against tech companies like Facebook FB and Microsoft MSFT, which are also leaving no stone unturned to bolster presence in this promising market.

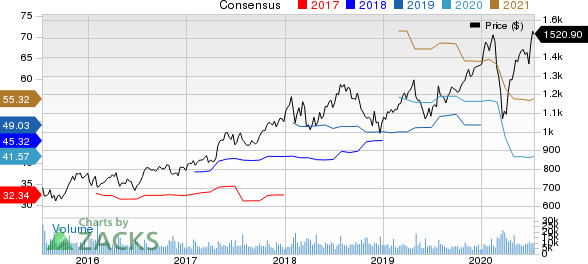

Alphabet Inc. Price and Consensus

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

Other Initiatives

Google is deepening focus on India, and continues to strengthen its reach in the country and aid the company’s global presence. The latest deal is a testament to the same.

Markedly, in May, it was reported that Google was in early stages of talks with the British telecom company, Vodafone, to acquire a 5% stake in the latter’s India business unit – Vodafone Idea.

Just recently, Google announced plans to invest $10 billion in India over the next five-seven years with an aim of focusing on areas that are related to India’s digitization.

We believe these endeavors bode well for Google’s persistent efforts toward expanding presence in India due to ongoing digitization in the country.

Intensifying Competition

Competition in the telecom space of India is intensifying, as growth opportunities in the country are alluring enough to attract foreign direct investments. Google’s latest move is a testament to this fact.

Google is the latest to join the growing list of investors in Reliance. Facebook invested $5.7 billion to buy a 10% stake in the company in April. Others include a slew of private equity firms like Vista Equity Partners, KKR and TPG.

Meanwhile, Microsoft is reportedly in negotiation terms with Mukesh Ambani to acquire more than 2.5% stake in Jio Platforms by investing up to $2 billion in it.

Nevertheless, Google’s growing endeavors remain noteworthy. The company has a strong relationship with Bharti Airtel, which is a strong competitor of Jio.

Airtel is one of the telecom operators on Google’s platform for operators that leverages the latter’s networking infrastructure including its data centers, edge servers and Content Delivery Networks.

Further, Google recently won a deal from Airtel. Per the deal, the latter received the authority to offer Google Cloud’s G Suite — a suite of cloud computing, productivity and collaboration tools, software and products — to business clients.

We believe the strengthening momentum of Google across telecom operators is likely to aid its presence in the telecom market of India.

Zacks Rank & Stock to Consider

Alphabet currently has a Zacks Rank #3 (Hold). A better-ranked stock in the broader technology sector is eBay EBAY, which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for eBay is currently projected at 11.7%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

Facebook, Inc. (FB) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research