GoPro (GPRO) Beats on Q1 Earnings, Revenues Increase Y/Y

GoPro, Inc GPRO reported first-quarter 2022 non-GAAP earnings came of 9 cents per share, which beat the Zacks Consensus Estimate by 80%. The company reported earnings of 3 cents in the year-ago quarter.

GoPro generated revenues of $216.7 million, up 6.4% from the year-ago quarter’s levels. It was in line with the consensus mark. The surge in revenues was mainly driven by robust sales of premium products along with an accretive subscriber base.

Strong retail partnerships and expanding direct-to-consumer business acted as tailwinds. Also, effective supply chain and channel inventory management and successful new product launches worked as major tailwinds.

For the second quarter, revenues are estimated to be $240 million (+/- $5 million). The Zacks Consensus Estimate stands at $270.9 million.

Non-GAAP adjusted earnings are expected to be 6 cents per share (+/-2 cents). The consensus mark is pegged at 15 cents per share.

Following the lower-than-expected outlook, the shares of GoPro are down 4.7% in the premarket trading on May 6. In the past year, shares have declined 19% compared with industry’s decline of 15.2%.

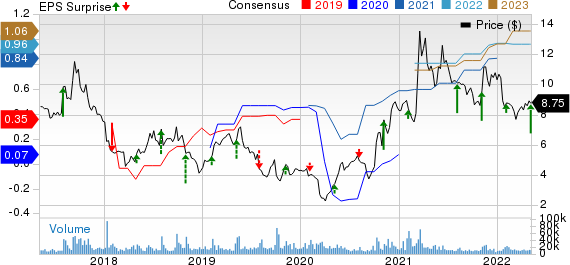

GoPro, Inc. Price, Consensus and EPS Surprise

GoPro, Inc. price-consensus-eps-surprise-chart | GoPro, Inc. Quote

Quarter in details

GoPro shipped 523 million camera units during the reported quarter, down 5.9% year over year, witnessing a sell-through of 600,00 units. Its channel inventory increased slightly in the first quarter, exiting the year with 650,000 camera units in the channel.

GoPro recorded 1.74 million subscribers, marking 85% year-over-year growth, at the close of the reported quarter.

Region-wise, revenues from the Americas came in at $102.6 million (47.3% of total revenues), down 4% from the year-ago quarter’s levels. Revenues from Europe, the Middle East and Africa were $61.5 million (28.4%), up 24% year over year. The Asia Pacific generated revenues of $52.6 million (24.3%), up 11% year over year.

Based on channels, revenues from GoPro.com were $88.6 million (40.9% of total revenues), up 7.9% year over year. The uptick was driven by higher direct-to-consumer and subscription revenues via GoPro.com. In the GoPro.com channel, hardware revenues totaled $70 million compared with $71.3 million in the prior-year quarter. Subscription revenues came in at $18.6 million, up 72.2% on a year-over-year basis.

Encouraged by a healthy momentum, the company aims to bolster margins with continued investments to enhance shopper experience on the back of robust website engagement and conversion.

Revenues from the Retail channel came in at $128.1 million (59.1%), up 5.3% from the year-ago quarter’s levels.

The company had $119.4 million in inventory compared with $111.8 million in the year-ago quarter.

Other Details

Gross profit was $90.4 million, up 15% year over year. Total operating expenses were $82.3 million, up 0.1%. Operating income came in at $8.2 million compared with $3.5 million of operating loss reported in the prior-year quarter.

Non-GAAP gross margin expanded 280 basis points to 42%. Adjusted EBITDA was $20.6 million, up 92.6% from the year-ago period.

Cameras with suggested retail prices at or above $400 contributed 92% to revenues in the reported quarter, up from 79% in the year-ago quarter. The upside reflects the growing demand for GoPro’s premium products.

Cash Flow & Liquidity

For the quarter under review, GoPro used $73.4 million of net cash from operating activities against $25.5 million reported in the year-ago period.

As of Mar 31, 2022, the company had $305.3 million in cash and cash equivalents with $140.3 million of long-term debt.

Guidance

For the second quarter, gross margins are expected to be 40.5% +/- 50 basis points. Street ASP is projected to be nearly $400.

Zacks Rank & Stocks to Consider

GoPro currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology sector are Flex FLEX, Jabil JBL and Broadcom AVGO. Flex and Jabil carry a Zacks Rank #1 (Strong Buy) while Broadcom carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Flex’s fiscal 2023 earnings is pegged at $2.16 per share, up 6.9% in the past 60 days. The long-term earnings growth rate is pegged at 14.9%.

Flex earnings beat the Zacks Consensus Estimate all last four quarters, with the average being 21.1%. Shares of FLEX have declined 7.9% in the past year.

The Zacks Consensus Estimate for Jabil fiscal 2022 earnings is pegged at $7.25 per share, up 10.2% in the past 60 days. The long-term earnings growth rate is 12%.

Jabil earnings beat the Zacks Consensus Estimate all last four quarters, the average being 13.5%. Shares of JBL have gained 6.6% in the past year.

The Zacks Consensus Estimate for Broadcom’s fiscal 2022 earnings is pegged at $35.67 per share, up 1.1% in the past 60 days. AVGO’s long-term earnings growth rate is pegged at 15.6%.

Broadcom’s earnings beat the Zacks Consensus Estimate in all the preceding four quarters, with the average being 1.9%. Shares of AVGO have increased 28.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GoPro, Inc. (GPRO) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Flex Ltd. (FLEX) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.