GPU Price Normalization Will be the Catalyst for Corsair Gaming (NASDAQ:CRSR)

This article first appeared on Simply Wall St News .

After months of sinking, Corsair Gaming, Inc.'s ( NASDAQ: CRSR ) is finally catching a break, but it is yet to reverse the bearish trend.

However, earnings beat paired with the improving balance sheet at an attractive valuation might be just the winning combination the company needs.

View our latest analysis for Corsair Gaming

Q4 Earnings Results

Non-GAAP EPS: US$0.35 (beat by US$0.10)

Revenue: US$510.6M (beat by US$13.66m)

Revenue growth: -8.2% Y/Y

2022 Guidance:

Revenue: US$1.9b-US$2.1b vs. US$2b consensus

Revenue in 2025: US$3.5b

Founder and CEO Andy Paul noted that despite the headwinds in 2021, the company launched 141 new products and increased the number of product lines to 30.

Reflecting on the shortages of high-end graphics cards, Mr.Paul estimates that approximately 10% of natural demand for Corsair products was held back due to gaming enthusiasts holding back on their purchases. This situation might provide a spike in demand as GPUs return to MSRP prices in the near future.

Meanwhile, Corsair signed a reseller agreement with Digital Motorsports (ESE Entertainment subsidiary). As an aspiring leader of the motorsport gaming category, Digital Motorsports will be adding Corsair's products to their platform.

A Look at Corsair Gaming's Valuation

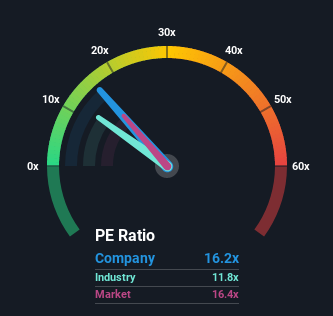

With a median price-to-earnings (or "P/E") ratio of close to 16x in the United States, you could be forgiven for feeling indifferent about Corsair Gaming, Inc.'s P/E ratio of 16.2x. However, our discounted cash flow valuation model shows that the stock could be trading as much as 70% below its fair value.

Corsair Gaming certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favor.

Want the complete picture of analyst estimates for the company? Then our free report on Corsair Gaming will help you uncover what's on the horizon.

What Are Growth Metrics Telling Us About The P/E?

Corsair Gaming's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a substantial increase of 61%.However, the latest three-year period hasn't been as significant in aggregate as it didn't manage to provide any growth at all.Therefore, it's fair to say that recent earnings growth has been inconsistent.

Looking ahead now, EPS is anticipated to climb by 6.3% per annum during the coming three years, according to the eight analysts following the company.That's shaping up to be materially lower than the 11% per year growth forecast for the broader market.

In light of this, it's curious that Corsair Gaming's P/E sits in line with most other companies.It seems most investors are ignoring the somewhat limited growth expectations and are willing to pay up for exposure to the stock.Yet, withheld demand due to the computer component supply and demand inbalances could be distorting this picture.

The Bottom Line On Corsair Gaming's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Yet, we have to note that the stock has exceptionally high short interest at over 30%. In the case of the positive catalyst, this could be a tipping point for a short squeeze, as the investors still remember similar situations with Game Stop or AMC Entertainment Holdings. However, compared to some of those short squeeze examples, we have to note that Corsair Gaming has a healthier balance sheet, as the debt to equity ratio has been on the decline. Considering the latest earnings report, it'd be worthwhile to follow the GPU sales trend to anticipate any spikes in Corsair's product sales.

While Corsair faces risks with GPU prices remaining elevated, there are some other risks worth knowing about. Case in point, we've spotted 2 warning signs for Corsair Gaming you should be aware of.

If these risks make you reconsider your opinion on Corsair Gaming , explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.