Graco (GGG) Q4 Earnings and Sales Surpass Estimates, Up Y/Y

Graco Inc. GGG delivered better-than-expected results for the fourth quarter of 2019. Its earnings and sales surpassed estimates by 23.1% and 5.2%, respectively. The results mark an improvement from weaker-than-expected results in the previous three quarters.

Adjusted earnings in the quarter under review were 48 cents per share, surpassing the Zacks Consensus Estimate of 39 cents. On a year-over-year basis, earnings increased 11.6%, driven by sales growth in the Americas and EMEA, partially offset by weakness in the Asia Pacific. Also, improved operating margin and lower taxes were reliefs.

For 2019, the company’s adjusted earnings were $1.90 per share, above the Zacks Consensus Estimate of $1.81. Also, the bottom line expanded 1.1% from the previous year’s number of $1.88.

Process and Contractor Segments Drive Revenues

In the reported quarter, Graco’s net sales were $412.3 million, suggesting a 1.5% increase from the year-ago quarter. Volume and price positively impacted sales by 1%, while acquisitions contributed 1%. However, forex woes had an adverse impact of 1%.

The company’s net sales surpassed the Zacks Consensus Estimate of $391.8 million.

On a geographical basis, quarterly sales generated from the Americas grew 4% to $232 million. In EMEA, sales were $112 million, increasing 11% year over year (or grew 14% at a constant-currency rate), while sales from the Asia Pacific were $68 million, declining 17% (or were down 16% at a constant-currency rate).

The company reports revenues under three segments. A brief discussion of the quarterly results is provided below:

The Industrial segment’s revenues totaled $194.8 million, suggesting a 2.4% decline from the year-ago quarter. Volume and price had an adverse impact of 1% on sales, and forex woes too lowered sales by 1%. The segment’s sales accounted for 47.2% of the company’s net revenues in the quarter.

The Process segment’s sales of $88.9 million were up 0.7% from the year-ago quarter. Acquisitions contributed 5% to sales growth, while volume and price had an adverse impact of 4% in the quarter. The segment’s sales accounted for 21.6% of net revenues in the reported quarter.

The Contractor segment generated revenues of $128.6 million, reflecting an 8.4% increase from the year-ago quarter. Volume and price had a positive impact of 9% on sales, while forex woes adversely influenced sales by 1%. The segment’s sales accounted for 31.2% of net revenues in the reported quarter.

For 2019, the company’s net sales were $1,646 million, reflecting a 0.4% decline from the year-ago quarter’s figure. However, the top line surpassed the Zacks Consensus Estimate of $1.63 billion.

Operating Margin Up Y/Y

In the reported quarter, Graco’s cost of sales increased 2.6% year over year to $202.9 million. It represented 49.2% of the quarter’s net sales versus 48.6% in the year-ago quarter. Gross profit grew 0.3% year over year to $209.4 million, while margin was down by 60 basis points (bps) to 50.8%. The fall in margin was triggered by unfavorable product and channel mix, forex woes and adverse factory volume. As noted, high costs of raw materials were offset by favorable pricing.

Operating expenses (including product development; selling, marketing and distribution; and general and administrative expenses) declined 6.2% year over year to $105.2 million. It represented 25.5% of net sales in the reported quarter versus 27.6% in the year-ago quarter.

Operating profit increased 7.9% year over year to $104.2 million. Margin grew 150 bps year over year to 25.3%. Interest expenses in the reported quarter decreased 31.3% year over year to $2.5 million. Effective tax rate in the quarter was 16%, down 2 percentage points from the previous-year quarter.

Balance Sheet & Cash Flow

Exiting the fourth quarter, Graco had cash and cash equivalents of $221 million, suggesting 24.6% increase from $177.3 million recorded in the last reported quarter. Long-term debt was down 14.5% sequentially to $164.3 million.

In 2019, the company generated net cash of $418.7 million from operating activities, 13.8% above the previous year. Capital spent on the addition of property, plant and equipment totaled $128 million versus $53.9 million in 2018.

The company distributed dividends worth $106.4 million and repurchased 160,000 shares for $9.5 million during the year.

Outlook

For 2020, Graco anticipates organic sales (at a constant-currency rate) to grow in low-single digits. The company believes that Process and Industrial segments’ performances will be adversely impacted by difficult end-market conditions in the first half of 2020. Meanwhile, solid demand for products will help boost Contractor’s performance.

For the Americas and EMEA, organic sales (at constant-currency rates) are predicted to increase in low-single digits in 2020. Organic sales for the Asia Pacific are expected to be flat year over year.

The company predicts capital expenditure of $70 million in the year. This includes $30 million for mortar and brick. Corporate expenses (unallocated) are estimated to be $30 million. Impact of foreign currency movements is predicted to be immaterial in 2020. However, modest adverse impacts of forex woes can be expected in the first half of the year. Effective tax rate is predicted to be 20% for the year.

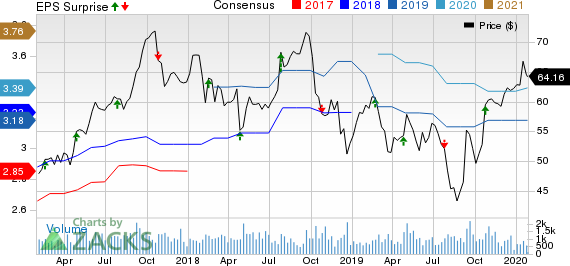

Barnes Group, Inc. Price, Consensus and EPS Surprise

Barnes Group, Inc. price-consensus-eps-surprise-chart | Barnes Group, Inc. Quote

Zacks Rank & Other Stocks to Consider

With a market capitalization of $8.7 billion, Graco currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the industry are DXP Enterprises, Inc. DXPE, Barnes Group, Inc. B and IDEX Corporation IEX. While DXP Enterprises sports a Zacks Rank #1 (strong Buy), both Barnes and IDEX carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for these companies have improved for the current year. Further, earnings surprise for the last four quarters, on average, was 17.67% for DXP Enterprises, 4.21% for Barnes and 3.26% for IDEX.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

IDEX Corporation (IEX) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

Barnes Group, Inc. (B) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research