Graco (GGG) Shares Increase 6.9% Since Q3 Earnings Release

Graco Inc.’s GGG shares have gained 6.9% since its third-quarter 2022 earnings release on Oct 26. Better-than-expected results seem to have impressed investors.

The company’s adjusted earnings of 66 cents per share beat the Zacks Consensus Estimate by a penny. The bottom line improved 15.8% year over year.

GGG’s net sales of $545.6 million also outperformed the Zacks Consensus Estimate of $523 million. The top line increased 12% year over year driven by solid performances in all segments. Volume growth and effective pricing contributed to sales growth.

On a regional basis, quarterly sales generated from the Americas grew 19%. In Europe, the Middle East and Africa (EMEA) region, sales decreased 3% year over year (or up 10% at the constant-currency rate). Sales from the Asia Pacific increased 10% (or up 18% at the constant-currency rate).

Segmental Details

Revenues for the Industrial segment totaled $156.2 million (contributing to 28.6% of the quarter’s sales), rising 1% year over year on the back of improved economic activities. Adverse foreign currency translations lowered sales by 7%. Core sales grew 8% year over year.

Revenues in the Process segment grossed $125.4 million (contributing to 23% of the quarter’s sales), increasing 30% year over year. The improvement came on the back of a 30% rise in core sales, driven by robust demand in all regions with continued growth in lubrication equipment, process pumps, environmental and semiconductor products.

Revenues in the Contractor segment totaled $264.1 million (contributing to 48.4% of the quarter’s sales), up 12% year over year driven by outperformance in North America, robust out-the-door sales and strong demand for the protective coatings and spray foam product lines. Core sales expanded 16%.

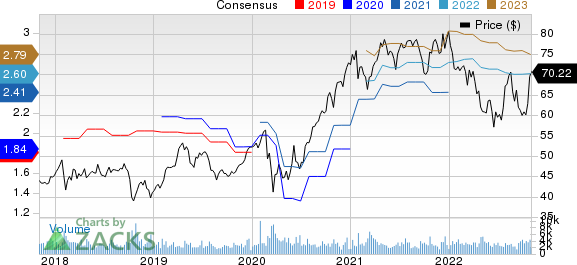

Graco Inc. Price and Consensus

Graco Inc. price-consensus-chart | Graco Inc. Quote

Margin Profile

In the third quarter, Graco’s cost of sales grew 19.3% year over year to $284.6 million. Gross profit increased 5.2% to $261.1 million, while the margin decreased 3.2 percentage points. An increase in product costs due to supply-chain woes and adverse foreign currency movement hurt the margin performance.

Operating expenses (including product development, selling, marketing and distribution as well as general and administrative expenses) decreased 5% year over year to $117.5 million. The same represented 21.5% of net sales in the reported quarter compared with 25.4% in the year-ago period.

Operating income increased 14.8% year over year to $143.1 million. Operating margin remained same from the year-ago quarter. Interest expenses in the quarter totaled $1.5 million compared with $2.5 million reported in the year-ago period. The adjusted tax rate in the quarter was 27.6%.

Balance Sheet and Cash Flow

Exiting the third quarter, Graco had cash and cash equivalents of $414.8 million compared with $624.3 million at the end of 2021. The long-term debt was $75 million, flat compared with the December 2021 level.

Graco generated net cash of $271.5 million from operating activities in the first nine months of 2022 compared with $357.2 million generated in the year-ago period. Capital used for purchasing property, plant and equipment totaled $147.2 million compared with $82.6 million in the year-ago period.

GGG paid out dividends worth $106.9 million to its shareholders in the first nine months of 2022, up 12.3% from the previous-year quarter. Graco repurchased shares worth $155.2 million in the first nine months of 2022.

Outlook

Amid microeconomic uncertainties, Graco expects to launch new products, explore new markets, expand its global channel and make strategic acquisitions. The company expects low double-digit organic revenue growth on a constant-currency basis for the full year compared with growth in high single-digit predicted earlier.

Zacks Rank & Stocks to Consider

Graco currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies from the Industrial Products sector are discussed below:

Enerpac Tool Group Corp. EPAC delivered an average four-quarter earnings surprise of 3.4%. EPAC presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

EPAC’s earnings estimates have increased 9.1% for fiscal 2023 (ending August 2023) in the past 60 days. The company’s shares have gained 25.1% in the past six months.

iRobot Corporation IRBT presently has a Zacks Rank of 2 (Buy). IRBT’s earnings surprise in the last four quarters was 59.1%, on average.

In the past 60 days, iRobot’s earnings estimates have increased 0.1% for 2022. The stock has rallied 6.6% in the past six months.

Reliance Steel & Aluminum Co. RS presently carries a Zacks Rank of 2. Its earnings surprise in the last four quarters was 13.6%, on average.

In the past 60 days, RS’s earnings estimates have increased 0.1% for 2022. The stock has popped up 0.2% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

iRobot Corporation (IRBT) : Free Stock Analysis Report

Enerpac Tool Group Corp. (EPAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research