GreenPower Motor Company Inc.'s (CVE:GPV) 28% Jump Shows Its Popularity With Investors

Those holding GreenPower Motor Company Inc. (CVE:GPV) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 57% share price decline over the last year.

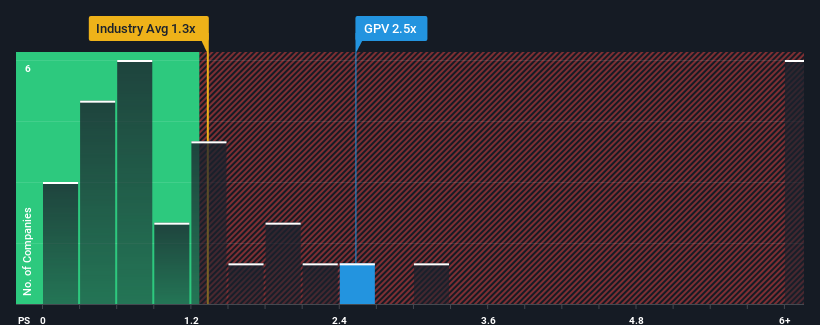

Following the firm bounce in price, you could be forgiven for thinking GreenPower Motor is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.5x, considering almost half the companies in Canada's Machinery industry have P/S ratios below 1.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for GreenPower Motor

What Does GreenPower Motor's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, GreenPower Motor has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on GreenPower Motor will help you uncover what's on the horizon.

Is There Enough Revenue Growth Forecasted For GreenPower Motor?

The only time you'd be truly comfortable seeing a P/S as high as GreenPower Motor's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 53% last year. Pleasingly, revenue has also lifted 87% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 97% per year as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 43% per annum growth forecast for the broader industry.

In light of this, it's understandable that GreenPower Motor's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does GreenPower Motor's P/S Mean For Investors?

GreenPower Motor shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into GreenPower Motor shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 3 warning signs for GreenPower Motor (1 doesn't sit too well with us!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here