Grocery Outlet (GO) Gains From Business Model & Expansion

Grocery Outlet Holding Corp.’s GO unique business model, strength in product offerings and store-growth endeavors place it well for growth. GO’s flexible sourcing and distribution business model that differentiates it from traditional retailers places it well for sustainable growth. Its opportunistic purchasing strategy and e-commerce initiatives to deepen customer reach appear encouraging as well. Let’s delve deeper.

Strategic Details

Grocery Outlet continues to navigate through the challenging operating environment. The company is building on the underlying strength of the business across areas such as opportunistic supply, product assortments as well as engagement with customers and independent operators. Additionally, Grocery Outlet has tested a mobile app in Washington State, whereby customers can view trending and top items in stores on a real-time basis and access curated product recommendations based on their preferences.

We believe that Grocery Outlet’s compelling value proposition will continue to encourage customers to revisit stores and increase basket sizes. Notably, its expanded product offerings, more “WOW!” Deals and increased customer awareness will help fuel sales. In terms of offerings, the company sources on-trend products based on consumer preferences. Moreover, with consumers now looking for fresh and healthy options, the company has shifted its focus to Natural, Organic, Specialty and Healthy or “NOSH” products.

Grocery Outlet provides customers with quality, name-brand consumables and fresh products at exceptional value. We note that a typical “Grocery Outlet basket” is priced roughly 40% below conventional grocers and approximately 20% below leading discounters. Moreover, to drive customers and keep them well informed about price, quality and service, the company has refreshed its brand image by updating its website, modernizing its logo and adopting a new marketing campaign.

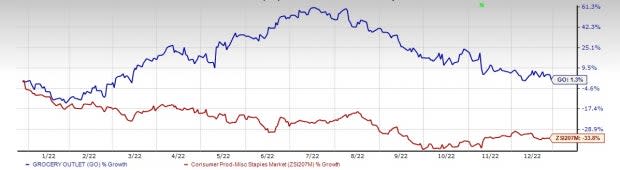

Image Source: Zacks Investment Research

Additionally, Grocery Outlet is striving to expand stores and undertake prudent marketing initiatives. The company is offering same-day delivery of everyday essentials and staples from all its stores in collaboration with Instacart and DoorDash. It has also teamed up with Uber Technologies to pilot on-demand and scheduled grocery delivery.

Management believes that there is room to expand to approximately 1,900 additional locations. In the long term, the company believes that there is potential to establish 4,800 locations nationally. Notably, the company has been undertaking strategic investments to improve its functionality and scalability. These include enhanced point of sale, warehouse management, vendor tracking, store communications, real estate lease management, and financial planning and analysis.

What’s More?

Impressively, the grocery retailer has managed to stay afloat amid a tough operating landscape. Its shares gained 1.3% in the past year against the industry’s 33.8% plunge. An expected long-term earnings growth rate of 11.9% further speaks volumes for this presently Zacks Rank #3 (Hold) stock.

Grocery Outlet reported third-quarter 2022 results, wherein the top and the bottom lines not only beat the Zacks Consensus Estimate but also improved year over year. The company registered a solid comparable store sales performance in the quarter. Stellar results and strong quarter-to-date trends prompted management to lift the net sales and earnings view for 2022.

On its last earnings call, management projected 2022 net sales of $3.55 billion compared with $3.08 billion in 2021 and comparable store sales growth of 11% against a 6% decline in 2021. It envisioned adjusted earnings of $1.00 per share for 2022, suggesting an increase from the 90 cents reported in 2021.

Analysts look optimistic about Grocery Outlet. For 2023, the Zacks Consensus Estimate for GO’s sales and earnings per share (EPS) is currently pegged at $3.90 billion and $1.11, respectively. These estimates suggest respective growth of 9.8% and 10.6% from the year-ago period’s corresponding figures.

On a concluding note, Grocery Outlet will continue performing well on the bourses, buoyed by the aforesaid strengths.

3 Better-Ranked Consumer Staples Stocks

Some better-ranked stocks are Archer Daniels Midland Company ADM, Lamb Weston LW and TreeHouse Foods THS.

Archer Daniels, a renowned producer of food and beverage ingredients, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Archer Daniels’ current financial-year sales suggests 19.9% growth from the year-ago reported number. ADM has a trailing four-quarter earnings surprise of 26.2%, on average.

Lamb Weston, a renowned global manufacturer and distributor of value-added frozen potato products, currently holds a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Lamb Weston’s current financial-year sales suggests growth of 14.6% from the year-ago reported number. LW has a trailing four-quarter earnings surprise of 47.3%, on average.

TreeHouse Foods, a manufacturer of packaged foods and beverages, currently has a Zacks Rank of 2. THS has a trailing four-quarter earnings surprise of 56.3%, on average.

The Zacks Consensus Estimate for TreeHouse Foods’ current financial-year sales suggests 2.3% growth from the year-ago period’s reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report