Grocery Outlet Holding (NASDAQ:GO) investors are sitting on a loss of 28% if they invested a year ago

It is doubtless a positive to see that the Grocery Outlet Holding Corp. (NASDAQ:GO) share price has gained some 32% in the last three months. But that doesn't change the reality of under-performance over the last twelve months. After all, the share price is down 28% in the last year, significantly under-performing the market.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Grocery Outlet Holding

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

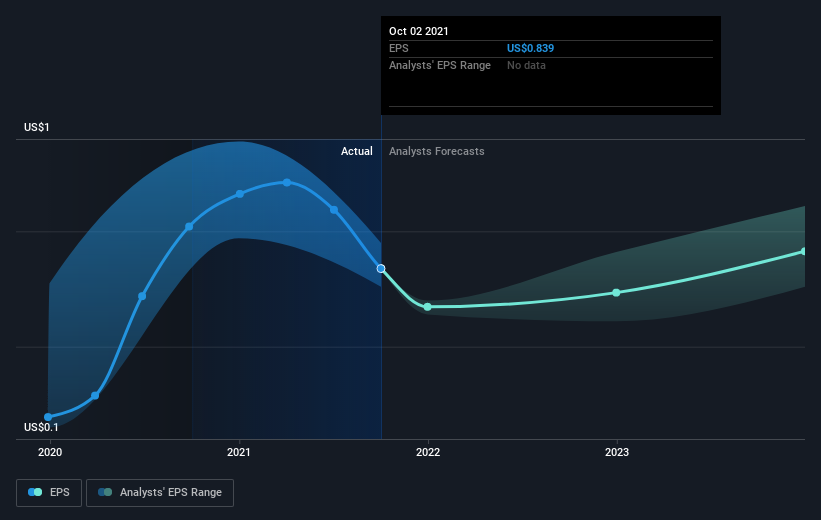

Unfortunately Grocery Outlet Holding reported an EPS drop of 19% for the last year. The share price decline of 28% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders are more nervous about the business.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Grocery Outlet Holding has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Grocery Outlet Holding stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Given that the market gained 21% in the last year, Grocery Outlet Holding shareholders might be miffed that they lost 28%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 32%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). Before spending more time on Grocery Outlet Holding it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.