Grocery stocks are getting crushed after Amazon's $13.7 billion deal to buy Whole Foods

Amazon (AMZN) is buying organic grocer Whole Foods (WFM) for $13.7 billion.

And after this deal’s announcement, almost any company that sells groceries is getting pummeled as investors brace for the competition brought on by Amazon’s entry into the space.

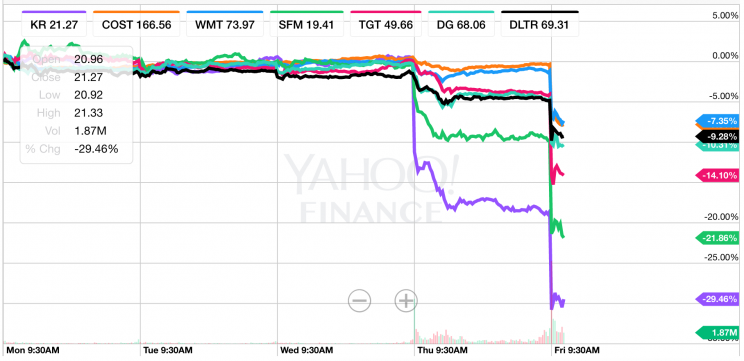

The most notable loser is Kroger (KR), the nation’s second-largest seller of groceries behind Walmart, down 13% in early trading on Friday.

Sprouts Farmers Market (SFM), an organic grocer which competes with Whole Foods, is also down 13%.

Walmart (WMT), which on Friday also announced a deal to acquire menswear retailer Bonobos for $310 million, was down 6% on Friday morning. In recent months, Walmart has been moving to more directly challenge Amazon’s business, namely its Prime membership offering by giving customers smaller minimum order sizes to qualify for free two-day shipping. Last year, Walmart bought online retailer Jet.com for $3 billion.

Other losers included Target (TGT), down 10%, and wholesale retailer Costco (COST) down 7% in early trade on Friday.

Also lower were shares of dollar stores Dollar General (DG), down 6%, and Dollar Tree (DLTR), down 4%. Shares of UK grocer Tesco were down 5% in afternoon trading in London on Friday.

And so it seems that Amazon’s major foray into the food space is weighing on shares of almost any company that sells food, whether at the grocery, wholesale, or ancillary level.

“The acquisition of Whole Foods by Amazon announced this morning puts grocers on notice that Amazon is going to be a serious and formidable player on the grocery business,” said Mickey Chadha, a vice president at Moody’s.

Chadha added that smaller regional supermarket chains and independent grocers should feel the most pain from Amazon’s entry into the grocery space, and said the sector is, like the brick-and-mortar retailers, about to learn what happens when a player with the “financial capacity to price aggressively” like Amazon comes into the market.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland