The Groupe Bruxelles Lambert (EBR:GBLB) Share Price Has Gained 21% And Shareholders Are Hoping For More

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, long term Groupe Bruxelles Lambert SA (EBR:GBLB) shareholders have enjoyed a 21% share price rise over the last half decade, well in excess of the market return of around 7.9% (not including dividends).

View our latest analysis for Groupe Bruxelles Lambert

To quote Buffett, ‘Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace…’ One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

During the last half decade, Groupe Bruxelles Lambert became profitable. That’s generally thought to be a genuine positive, so we would expect to see an increasing share price.

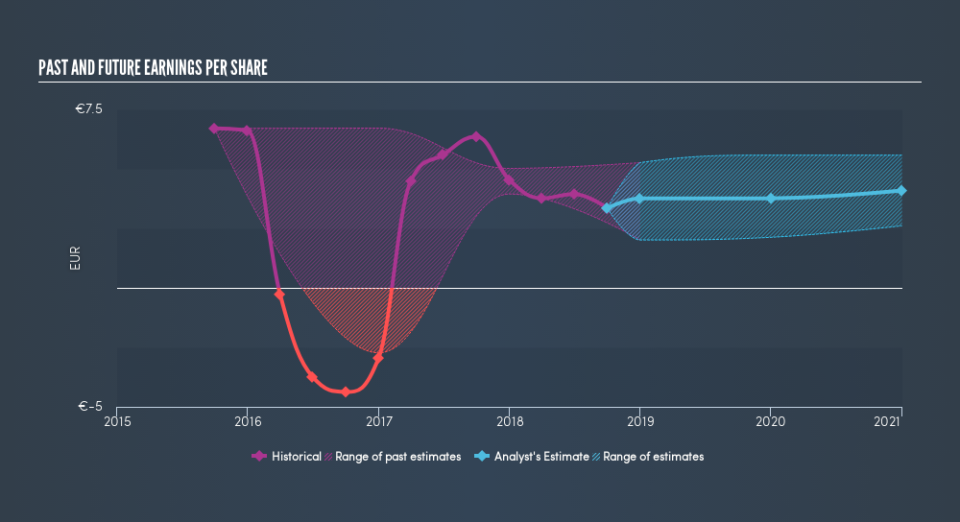

The company’s earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Groupe Bruxelles Lambert the TSR over the last 5 years was 37%, which is better than the share price return mentioned above. And there’s no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While it’s never nice to take a loss, Groupe Bruxelles Lambert shareholders can take comfort that, including dividends, their trailing twelve month loss of 5.8% wasn’t as bad as the market loss of around 13%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 6.6% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. Keeping this in mind, a solid next step might be to take a look at Groupe Bruxelles Lambert’s dividend track record. This free interactive graph is a great place to start.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.