Growing Risk Appetite Favors Cyclical Precious Metals ETFs

Risk appetite has been rising as economic growth continues to surprise to the upside. US, Chinese and German manufacturing (Markit) purchasing managers indices, the US Conference Board’s Leading Economic Indicator and Germany’s IFO and ZEW surveys all came in above consensus expectations, pushing investors to increase their holdings of cyclical assets.

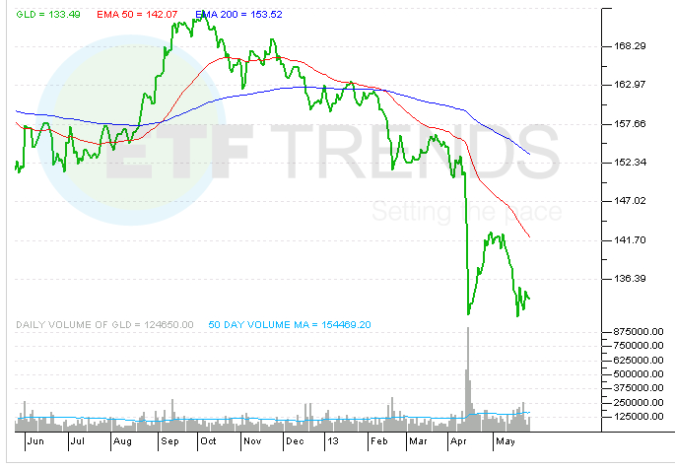

European banks also surprised markets by the pace at which they intend to pay back loans from the ECB’s longer-term refinancing operation in a sign that their central bank dependency has eased. Gold and silver edged down 1.7% and 0.8% while the platinum group metals, which carry more cyclical properties ended up slightly higher on the week.

Although parts of the global economy seem to be performing better than anticipated, parts of Europe are extremely sluggish with UK Q4 GDP contracting by 0.3% and French PMIs seeing their steepest downturn since 2009. Continued policy uncertainty in the US and escalating “currency wars” are likely to maintain interest in precious metals which provide protection against worst case outcomes.

Central banks to take the center stage. The Bank of Japan announced that it will adopt a formal, higher inflation target of 2% and step up its asset purchase program. The more aggressive policies from Japan are viewed by some as an escalation of the “currency war” and some central banks seek to diversify their reserves away from debased currencies with more gold. The Russian Central Bank increased its gold holdings by 8.5% in 2012 and has announced that it will continue to buy gold, possibly taking its gold holdings over the current level of 10% of its foreign exchange reserves.

The Kazakhstan Central Bank increased its gold holdings by 41% in 2012. A number other monetary authorities, including the Vietnamese Central Bank, the Turkish Central Bank and the Indian government are taking a more direct role in facilitating the use of gold as a monetary medium, in part easing the pressure on their exchange rates. There is even a campaign in Switzerland gaining traction to increase the gold holdings of its central bank. Meanwhile, to curb the strong demand for gold from Indian households (and the impact on the country’s current account deficit), India raised the import duty on gold from 4% to 6%.

US debt ceiling raised and so are the stakes. The US House passed a bill to raise the debt ceiling until May 2013, and has tied a clause to keep lawmakers from collecting their salaries if they do not pass a budget by mid-April. The failure to produce a credible budget in April would severely threaten to undo the return in risk appetite.

There are now doubts that the cuts in defense spending due to come in March won’t be reversed, taking budget forecasters by surprise in a clear sign that politicians are continuing to use the same political blackmail tactics used in 2011 when the US lost its coveted AAA rating from S&P. The fact that both the US and Canadian mints have run out of silver coins, may be a sign that demand for insurance against the worst case outcomes remains strong among certain investors.

Key events to watch this week: FOMC and US non-farm payrolls. The payrolls data, a key bellwether for US economic performance will be closely watched. Following the FOMC’s December meeting where a discussion on QE exit timing was first raised, there will be heightened interest in this week’s meeting.

ETFS Physical Swiss Gold Shares (SGOL)