Growth Stocks To Watch Out For In December

Most investors find it challenging to find companies with prospective double-digit growth rates that are also financially robust. These hidden gems also add meaningful upside to a portfolio, should the companies meet expectations. I would suggest taking a look at my list of companies that compare favourably in all criteria, and consider whether they would add value to your current portfolio.

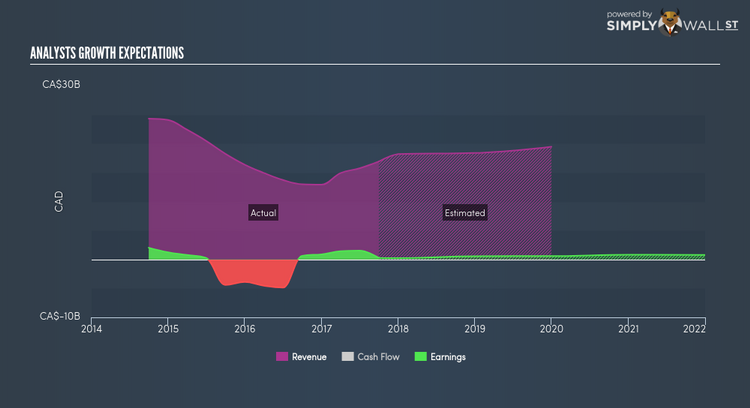

Husky Energy Inc. (TSX:HSE)

Husky Energy Inc., together with its subsidiaries, operates as an integrated energy company. Established in 1982, and currently lead by Robert Peabody, the company provides employment to 5,150 people and with the stock’s market cap sitting at CAD CA$16.55B, it comes under the large-cap category.

An outstanding doubling of earnings is forecasted for HSE, driven by an underlying sales growth of 13.40% over the next few years. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of HSE, it does not appear extreme. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 2.49%. HSE’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Want to know more about HSE? Other fundamental factors you should also consider can be found here.

Brick Brewing Co. Limited (TSX:BRB)

Brick Brewing Co. Limited produces, sells, markets, and distributes packaged and draft premium beer under the Waterloo brand; and value beer under the Laker, Red Baron, Red Cap, and Formosa brands in Canada and the United States. Started in 1984, and currently lead by George Croft, the company provides employment to 144 people and has a market cap of CAD CA$126.20M, putting it in the small-cap stocks category.

Extreme optimism for BRB, as market analysts projected an outstanding earnings growth rate of 65.26% for the stock, supported by a double-digit sales growth of 19.73%. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of BRB, it does not appear extreme. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 14.07%. BRB’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Thinking of investing in BRB? Other fundamental factors you should also consider can be found here.

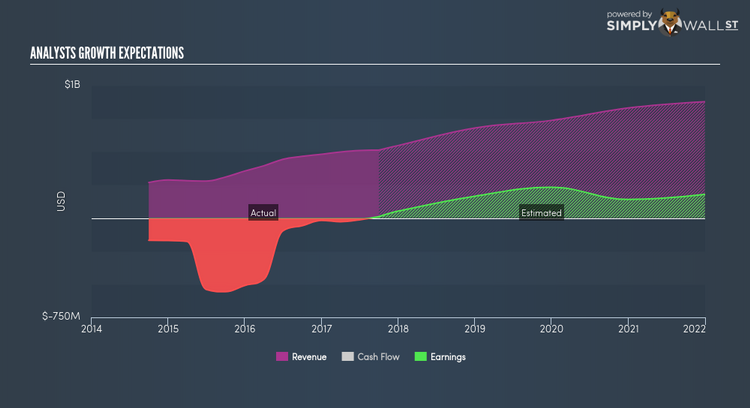

Alamos Gold Inc. (TSX:AGI)

Alamos Gold Inc., together with its subsidiaries, engages in the acquisition, exploration, development, and extraction of gold deposits in North America. The company size now stands at 1300 people and with the company’s market cap sitting at CAD CA$3.05B, it falls under the mid-cap category.

An outstanding doubling of earnings is forecasted for AGI, driven by an underlying sales growth of 40.83% over the next few years. Although reduction in cost is not the most sustainable operational activity, the expanding top-line growth, on the other hand, is encouraging. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 7.43%. AGI’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Considering AGI as a potential investment? Check out its fundamental factors here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.