Is Grupo Financiero Galicia S.A. (GGAL) A Good Stock To Buy?

How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don't always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Grupo Financiero Galicia S.A. (NASDAQ:GGAL).

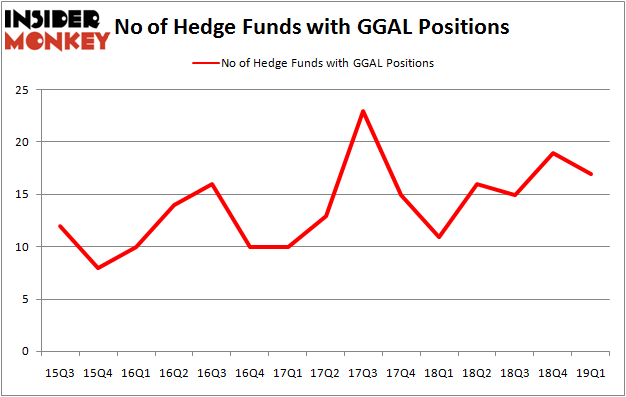

Is Grupo Financiero Galicia S.A. (NASDAQ:GGAL) ready to rally soon? Investors who are in the know are in a pessimistic mood. The number of long hedge fund positions went down by 2 in recent months. Our calculations also showed that GGAL isn't among the 30 most popular stocks among hedge funds. GGAL was in 17 hedge funds' portfolios at the end of the first quarter of 2019. There were 19 hedge funds in our database with GGAL positions at the end of the previous quarter.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds' small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren't comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We're going to review the key hedge fund action encompassing Grupo Financiero Galicia S.A. (NASDAQ:GGAL).

Hedge fund activity in Grupo Financiero Galicia S.A. (NASDAQ:GGAL)

Heading into the second quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -11% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards GGAL over the last 15 quarters. So, let's check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, EMS Capital, managed by Edmond M. Safra, holds the largest position in Grupo Financiero Galicia S.A. (NASDAQ:GGAL). EMS Capital has a $26.7 million position in the stock, comprising 2% of its 13F portfolio. Sitting at the No. 2 spot is Millennium Management, led by Israel Englander, holding a $21.7 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions encompass Crispin Odey's Odey Asset Management Group, Robert Charles Gibbins's Autonomy Capital and John Horseman's Horseman Capital Management.

Because Grupo Financiero Galicia S.A. (NASDAQ:GGAL) has experienced bearish sentiment from hedge fund managers, it's safe to say that there was a specific group of funds who sold off their full holdings heading into Q3. At the top of the heap, David Halpert's Prince Street Capital Management sold off the largest stake of all the hedgies monitored by Insider Monkey, totaling close to $20.2 million in stock. Richard Driehaus's fund, Driehaus Capital, also said goodbye to its stock, about $15.7 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest dropped by 2 funds heading into Q3.

Let's now take a look at hedge fund activity in other stocks similar to Grupo Financiero Galicia S.A. (NASDAQ:GGAL). We will take a look at American Eagle Outfitters Inc. (NYSE:AEO), Wyndham Destinations, Inc. (NYSE:WYND), ACI Worldwide Inc (NASDAQ:ACIW), and Air Lease Corp (NYSE:AL). All of these stocks' market caps are closest to GGAL's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position AEO,25,459761,-2 WYND,25,139648,5 ACIW,23,347597,2 AL,23,312641,-10 Average,24,314912,-1.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $315 million. That figure was $115 million in GGAL's case. American Eagle Outfitters Inc. (NYSE:AEO) is the most popular stock in this table. On the other hand ACI Worldwide Inc (NASDAQ:ACIW) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks Grupo Financiero Galicia S.A. (NASDAQ:GGAL) is even less popular than ACIW. Hedge funds clearly dropped the ball on GGAL as the stock delivered strong returns, though hedge funds' consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on GGAL as the stock returned 29.8% during the same period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index