GSK's Myelofibrosis Candidate MAA Gets Accepted in Europe

GSK plc GSK announced that the European Medicines Agency (EMA) has validated its marketing authorization application (MAA) seeking approval for momelotinib, an oral treatment for myelofibrosis, a fatal cancer of the bone marrow.

An opinion of the Committee for Medicinal Products for Human Use (CHMP) in Europe is expected by the end of 2023. A new drug application (NDA) for momelotinib is under standard FDA review, with a decision expected on Jun 16, 2023.

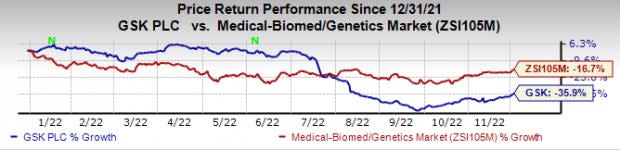

GSK’s stock has declined 35.9% this year so far compared with a decline of 16.7% for the industry.

Image Source: Zacks Investment Research

Momelotinib was added to GSK’s hematology portfolio with the July acquisition of California-based cancer biotech, Sierra Oncology. The regulatory filings for momelotinib were based on data from key phase III studies, including the pivotal MOMENTUM study, which evaluated momelotinib versus danazol for treating anemic myelofibrosis patients previously treated with an approved JAK inhibitor.

Myelofibrosis disease often leads to anemia that causes fatigue, an increased risk of infection and bleeding or bruising due to reduced platelet count in patients. In the MOMENTUM study, momelotinib achieved statistical significance in the primary and all pre-specified secondary endpoints, reporting a statistically significant benefit on symptoms, anemia and splenic size.

Zacks Rank & Stocks to Consider

GSK currently has a Zacks Rank #3 (Hold).

Some better-ranked large drugmakers are Vertex Pharmaceuticals VRTX, Merck MRK and Gilead Sciences GILD, all carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Vertex Pharmaceuticals’ stock has risen 46.3% this year so far. Estimates for Vertex’s 2022 earnings have gone up from $14.21 to $14.61 per share, while that for 2023 have increased from $15.09 to $15.60 per share over the past 60 days. Vertex has a four-quarter earnings surprise of 3.16%, on average.

Merck’s earnings per share estimates for 2022 have increased from $7.31 per share to $7.38, while that for 2023 increased from $7.21 per share to $7.34 in the past 30 days. Merck’s stock is up 43.6% in the year-to-date period.

Merck beat earnings expectations in all the trailing four quarters. The company delivered a four-quarter earnings surprise of 16.07%, on average.

Estimates for Gilead’s 2022 earnings per share have increased from $6.61 per share to $7.09 per share, while that for 2023 have increased from $6.30 per share to $6.80 per share in the past 30 days. Gilead’s stock is up 22.6% in the year-to-date period.

Gilead beat earnings expectations in three of the trailing four quarters. The company delivered a four-quarter earnings surprise of 0.36%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report