Is GTY Technology Holdings, Inc. (GTYH) A Good Stock To Buy?

Is GTY Technology Holdings, Inc. (NASDAQ:GTYH) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

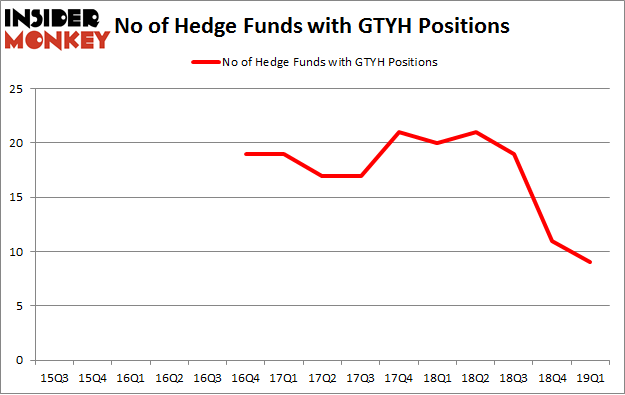

Is GTY Technology Holdings, Inc. (NASDAQ:GTYH) the right pick for your portfolio? Investors who are in the know are getting less bullish. The number of long hedge fund bets shrunk by 2 recently. Our calculations also showed that gtyh isn't among the 30 most popular stocks among hedge funds.

To the average investor there are dozens of metrics stock traders use to appraise their holdings. A duo of the most under-the-radar metrics are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the elite hedge fund managers can trounce the broader indices by a significant margin (see the details here).

We're going to check out the key hedge fund action surrounding GTY Technology Holdings, Inc. (NASDAQ:GTYH).

How are hedge funds trading GTY Technology Holdings, Inc. (NASDAQ:GTYH)?

Heading into the second quarter of 2019, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of -18% from the fourth quarter of 2018. By comparison, 20 hedge funds held shares or bullish call options in GTYH a year ago. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Alyeska Investment Group, managed by Anand Parekh, holds the most valuable position in GTY Technology Holdings, Inc. (NASDAQ:GTYH). Alyeska Investment Group has a $10 million call position in the stock, comprising 0.1% of its 13F portfolio. On Alyeska Investment Group's heels is John M. Angelo and Michael L. Gordon of Angelo Gordon & Co, with a $10 million position; 0.9% of its 13F portfolio is allocated to the company. Other members of the smart money that are bullish encompass Seth Klarman's Baupost Group, Glenn Russell Dubin's Highbridge Capital Management and John A. Levin's Levin Capital Strategies.

Because GTY Technology Holdings, Inc. (NASDAQ:GTYH) has faced declining sentiment from the entirety of the hedge funds we track, it's easy to see that there exists a select few funds that decided to sell off their positions entirely by the end of the third quarter. Intriguingly, Paul Singer's Elliott Management sold off the biggest stake of the "upper crust" of funds watched by Insider Monkey, worth about $44.2 million in stock. Paul Glazer's fund, Glazer Capital, also cut its stock, about $38.2 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest fell by 2 funds by the end of the third quarter.

Let's now review hedge fund activity in other stocks - not necessarily in the same industry as GTY Technology Holdings, Inc. (NASDAQ:GTYH) but similarly valued. These stocks are Cowen Inc. (NASDAQ:COWN), Fluent, Inc. (NASDAQ:FLNT), Computer Programs & Systems, Inc. (NASDAQ:CPSI), and Kaleido BioSciences, Inc. (NASDAQ:KLDO). This group of stocks' market valuations are similar to GTYH's market valuation.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position COWN,21,96363,4 FLNT,9,6703,4 CPSI,18,45626,5 KLDO,6,17238,6 Average,13.5,41483,4.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $41 million. That figure was $14 million in GTYH's case. Cowen Inc. (NASDAQ:COWN) is the most popular stock in this table. On the other hand Kaleido BioSciences, Inc. (NASDAQ:KLDO) is the least popular one with only 6 bullish hedge fund positions. GTY Technology Holdings, Inc. (NASDAQ:GTYH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately GTYH wasn't nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); GTYH investors were disappointed as the stock returned -4.5% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index