Guess? (GES) Stock Declines Despite Q4 Earnings, Revenue Beat

Guess? Inc. GES reported fourth-quarter fiscal 2023 results, with both top and bottom lines increasing year over year and beating the Zacks Consensus Estimate.

However, the operating margin contracted due to elevated costs, among other factors. Management expects to post a loss in the first quarter of fiscal 2024, wherein it expects revenues to decline. Shares of the company lost 6.8% during the after-market trading session on Mar 14.

Results in Detail

Guess? posted adjusted earnings of $1.74 per share, up 52.6% from $1.14 reported in the year-ago quarter. Earnings were positively impacted by share buybacks, partly hurt by a negative impact of currency translations. The bottom line surpassed the Zacks Consensus Estimate of $1.30 per share.

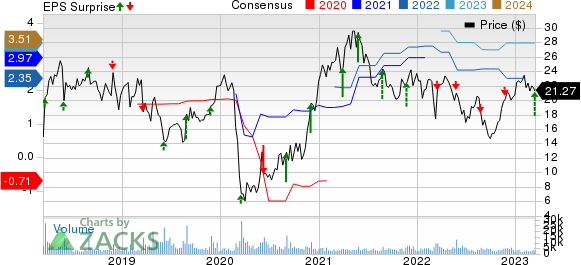

Guess?, Inc. Price, Consensus and EPS Surprise

Guess?, Inc. price-consensus-eps-surprise-chart | Guess?, Inc. Quote

Net revenues amounted to $817.8 million, surpassing the consensus mark of $772 million. The metric advanced 2% from the figure reported in the year-ago quarter. On a constant-currency (cc) basis, net revenues increased 8%, mainly led by strength of the company’s business in Europe.

The company’s gross margin contracted to 44.2% from 46.3% reported in the year-ago quarter. As a percentage of sales, SG&A expenses increased to 31.1% from 30.7% in the prior-year quarter’s level.

In the fourth quarter of fiscal 2023, adjusted earnings from operations came in at $107.5 million, down 14% from $125.7 million reported in the year-ago quarter. The adjusted operating margin contracted to 2.6% from 13.1% owing to escalated costs, reduced government subsidies, increased markdowns and currency headwinds, somewhat negated by expense leverage.

Segment Performance

Revenues in the Americas Retail segment fell 1% year over year on a reported basis and at cc. Retail comp sales (including e-commerce) remained nearly flat on a reported basis and at cc. The segmental operating margin declined to 1.8% from 15.4%.

Americas Wholesale revenues fell 7% on a reported basis and at cc. The segmental operating margin came in at 20.9%, down 4.5% year over year.

The Europe segment’s revenues jumped 10% on a reported basis and rose 20% at cc. Retail comp sales (including e-commerce) climbed 1% on a reported basis and increased 10% at cc. The segmental operating margin dropped 2.6% from 16%.

Asia revenues fell 8% on a reported basis but rose 1% at cc. Retail comp sales (including e-commerce) declined 8% on a reported basis while the same increased 1% at cc. The segmental operating margin fell from 3.7% to 2.8%.

Licensing revenues tumbled 8% on a reported basis and at cc. The segmental operating margin came in at 88.2% compared with 90.5% in the year-ago quarter.

Other Updates

This Zacks Rank #3 (Hold) company exited the quarter with cash and cash equivalents of $275.8 million and long-term debt and finance lease obligations of $95.9 million. Stockholders’ equity was $534.1 million. Net cash provided by operating activities for the fiscal year ended Jan 28, 2023, amounted to $169.2 million.

GES declared a quarterly dividend of 22.5 cents, payable on Apr 14, 2023, to shareholders on record as of Mar 29.

During fiscal 2023, management repurchased nearly 0.5 million shares, amounting to $11.7 million. Also, in March 2022, Guess? entered into an accelerated share repurchase agreement, as part of which it received about 8.5 million shares of common stock for $175.0 million. The company repurchased nearly 9 million shares for $186.7 million in fiscal 2023.

Guidance

For fiscal 2024, Guess? anticipates revenues to grow by 1-3%. GAAP operating margin is likely to be 8-9%. Management expects adjusted earnings per share (EPS) of $2.45-$2.80 compared with $2.74 recorded in fiscal 2023. On a GAAP basis, EPS is envisioned in the range of $2.08-$2.36 compared with $2.18 reported in fiscal 2023.

For the first quarter of fiscal 2024, management expects revenues to decrease 7-6%. On an adjusted basis, the company expects to post a loss of 31-25 cents per share. On a GAAP basis, it expects a loss per share of 25-19 cents for the first quarter of fiscal 2024.

GES’s stock has gained 31.8% in the past six months against the industry’s 7% decline.

3 Stocks to Consider

We have highlighted three better-ranked stocks, including Ralph Lauren RL, Crocs CROX and Kontoor Brands KTB.

Ralph Lauren currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for Ralph Lauren’s current financial-year sales suggests growth of 2.5% from the year-ago period.

RL, a designer, marketer and distributor of lifestyle products, has a trailing four-quarter earnings surprise of 23.6%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Crocs, which is a casual lifestyle footwear and accessories company, carries a Zacks Rank #2 (Buy) at present. CROX has a trailing four-quarter earnings surprise of 21.8%, on average.

The Zacks Consensus Estimate for Crocs’ current financial-year revenues suggests growth of 12.5% from the year-ago reported figure.

Kontoor Brands, a denim, apparel, footwear, and accessories company, carries a Zacks Rank #2. KTB has a trailing four-quarter earnings surprise of 12.4%, on average.

The Zacks Consensus Estimate for Kontoor Brands’ current financial-year sales suggests growth of 2.5% from the year-ago period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Kontoor Brands, Inc. (KTB) : Free Stock Analysis Report