Guest Commentary: Gold & Silver Daily Outlook 11.28.2012

The prices of gold and silver slightly declined along with other commodities prices such ad crude oil, stocks and the major risk currencies. The U.S consumer confidence report came out yesterday: the index for November slightly rose. The U.S core durable goods report was also positive: new orders for manufacturing durable goods slightly increased during October to reach $216.9 billion. These two reports showed some positive signal for the progress of the U.S economy. This news may have moderately affected the prices of precious metals. The ruling by the EU ministers of finance on Greece's bailout didn't lead to a rise in the Euro. Perhaps, many Euro traders had already anticipated this decision and thus it didn't affect the Euro or related currencies and commodities. On today's agenda: Euro Area Monetary Development, U.S New Home Sales, SNB Chairman Jordan's Speech and Australia Private New Capital Expenditure.

On Tuesday, the price of gold declined by 0.42% to $1,742.3; Silver price also decreased by 0.46% to $33.981. During the month, gold rose by 1.35%; silver, by 5.15%.

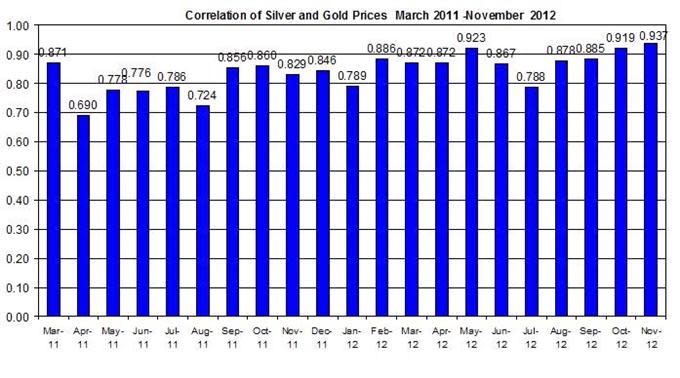

Despite the different directions gold and silver took in recent days, the linear correlation of the two precious metal daily percent changes is still robust, as indicated in the chart below. During November the linear correlation of their daily percent changes reached 0.937 – the highest this year so far, which means the two metals' relation has tighten during the month.

On Today's Agenda

U.S. New Home Sales: in the previous report, the sales of new homes rose to an annual rate of 389,000 – a 5.7% rise (month over month); if home sales will continue to rise, it may indicate a sign of recovery in the U.S housing market, which may also affect the strength of the USD and bullion prices;

Australia Private New Capital Expenditure: This quarterly report presents the changes in the private new capital expenditures and expected expenditures for the third quarter of 2012. As of the previous quarter, the seasonal adjusted total of new capital expenditure rose by 3.4% (Q-o-Q) and by 27.4% compared to the previous quarter in 2011. If this upward trend continues, it may positively affect the Aussie dollar, which tends to be strongly correlated with commodities.

For further reading: Gold And Silver Outlook For November 26-30

By: Lior Cohen, M.A. in Economics, Commodities Analyst and Blogger at Trading NRG

Would you like to see more third-party contributors on DailyFX? For questions and comments, please send them to research@dailyfx.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.