Guidewire (GWRE) Q4 Earnings & Revenues Top Estimates, Down Y/Y

Guidewire Software GWRE reported fourth-quarter fiscal 2021 non-GAAP earnings of 37 cents per share, beating the Zacks Consensus Estimate by 32.1% but declining 55.4% year over year.

The company reported revenues of $229.4 million, which beat the Zacks Consensus Estimate by 3.3% but declined 5.8% year over year.

Guidewire closed a record 17 core cloud deals, including 16 for Insurance Suite in the fourth quarter.

Quarter in Detail

Subscription and support revenues (30.5% of total revenues) increased 29.3% from the year-ago quarter to $70 million due to higher subscription revenues, which jumped 47% to $48.6 million.

Support revenues were up 1.8% year over year to $21.4 million in the quarter under review.

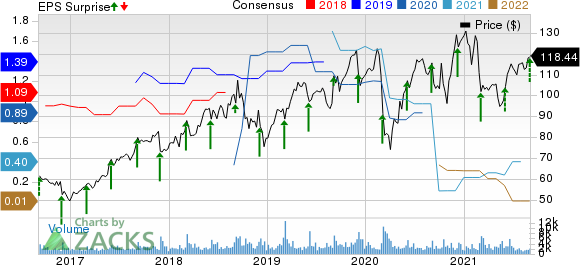

Guidewire Software, Inc. Price, Consensus and EPS Surprise

Guidewire Software, Inc. price-consensus-eps-surprise-chart | Guidewire Software, Inc. Quote

License revenues (47.8% of total revenues) declined 20.3% year over year to $109.7 million while Services revenues (21.7% of total revenues) fell 4.2% year over year to $49.8 million.

Annual recurring revenues (ARR) were $575 million as of Jul 31, 2021, compared with $509 million as of Jul 30, 2020.

Non-GAAP gross margin contracted 810 basis points (bps) on a year-over-year basis to 60.8%.

Total operating expenses increased 16% year over year to $129.4 million.

Non-GAAP operating income was $32 million, down 58.1% year over year.

Balance Sheet

As of Jul 31, 2021, cash and cash equivalents and short-term investments came in at $1.1 billion compared with $1.3 billion as of Apr 30, 2021.

The company generated cash of $108.4 million from operating activities compared with $5.6 million reported in third-quarter fiscal 2021. Adjusted free cash flow was $82.7 million.

In the quarter under review, Guidewire repurchased 0.4 million shares worth $38.8 million.

Guidance

For first-quarter fiscal 2022, revenues are expected in the range of $162-$166 million. ARR is expected between $586 million and $590 million.

Non-GAAP operating loss is projected in the range of $23-$27 million.

For fiscal 2022, the company expects total revenues between $780 million and $790 million. ARR is expected between $657 million and $667 million.

Non-GAAP operating loss for fiscal 2022 is projected in the range of $28-$38 million.

For fiscal 2022, cash flow from operations is projected in the range of $30-$40 million.

Zacks Rank & Stocks to Consider

Guidewire currently has a Zacks Rank #3 (Hold).

Apple AAPL, Advanced Micro Devices AMD and Zscaler ZS are better-ranked stocks in the broader computer & technology sector. All the three stocks carry Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long term earnings growth rate for Apple, AMD and Zscaler stands at 12.7%, 44.6% and 50.6%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Guidewire Software, Inc. (GWRE) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

To read this article on Zacks.com click here.