If You Had Bought Axonics Modulation Technologies (NASDAQ:AXNX) Shares A Year Ago You'd Have Earned 87% Returns

Passive investing in index funds can generate returns that roughly match the overall market. But you can significantly boost your returns by picking above-average stocks. To wit, the Axonics Modulation Technologies, Inc. (NASDAQ:AXNX) share price is 87% higher than it was a year ago, much better than the market return of around 21% (not including dividends) in the same period. So that should have shareholders smiling. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

View our latest analysis for Axonics Modulation Technologies

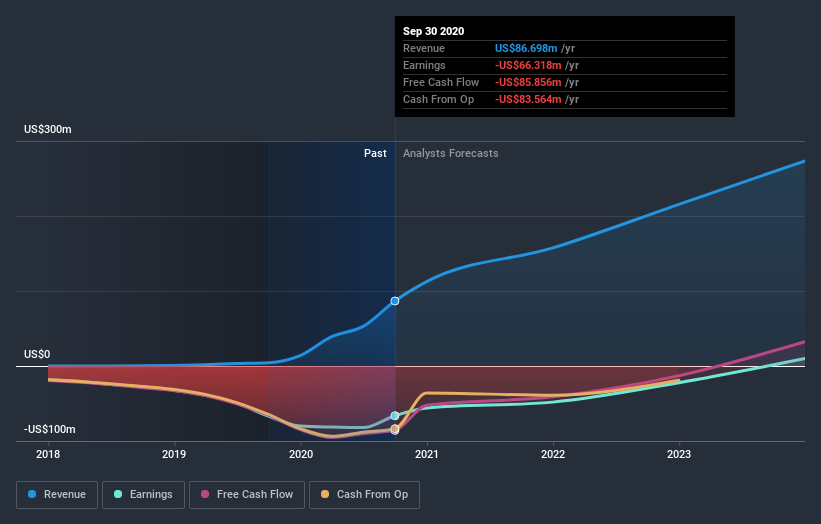

Axonics Modulation Technologies wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Axonics Modulation Technologies saw its revenue grow by 1,839%. That's stonking growth even when compared to other loss-making stocks. While the share price gain of 87% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. So quite frankly it could be a good time to investigate Axonics Modulation Technologies in some detail. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Axonics Modulation Technologies' financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Axonics Modulation Technologies shareholders have gained 87% over the last year. That's better than the more recent three month gain of 3.6%, implying that share price has plateaued recently. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Axonics Modulation Technologies you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.