If You Had Bought Bojun Education (HKG:1758) Stock A Year Ago, You'd Be Sitting On A 67% Loss, Today

Taking the occasional loss comes part and parcel with investing on the stock market. And unfortunately for Bojun Education Company Limited (HKG:1758) shareholders, the stock is a lot lower today than it was a year ago. The share price has slid 67% in that time. We wouldn't rush to judgement on Bojun Education because we don't have a long term history to look at. Furthermore, it's down 30% in about a quarter. That's not much fun for holders.

View our latest analysis for Bojun Education

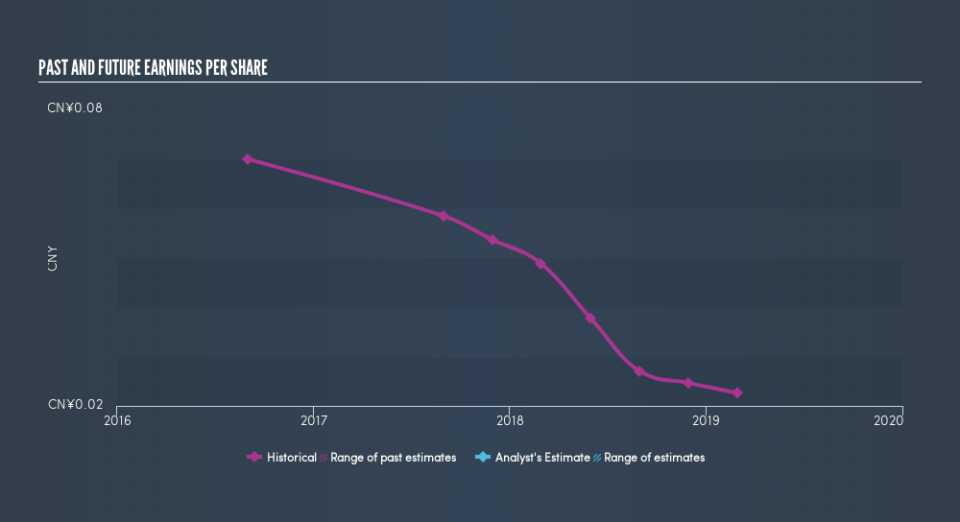

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Bojun Education reported an EPS drop of 54% for the last year. The share price decline of 67% is actually more than the EPS drop. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Bojun Education's earnings, revenue and cash flow.

A Different Perspective

Bojun Education shareholders are down 67% for the year, even worse than the market loss of 4.7%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 30% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Is Bojun Education cheap compared to other companies? These 3 valuation measures might help you decide.

But note: Bojun Education may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.