If You Had Bought Centennial Resource Development (NASDAQ:CDEV) Stock A Year Ago, You'd Be Sitting On A 83% Loss, Today

It's not a secret that every investor will make bad investments, from time to time. But it should be a priority to avoid stomach churning catastrophes, wherever possible. It must have been painful to be a Centennial Resource Development, Inc. (NASDAQ:CDEV) shareholder over the last year, since the stock price plummeted 83% in that time. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. To make matters worse, the returns over three years have also been really disappointing (the share price is 76% lower than three years ago). Furthermore, it's down 50% in about a quarter. That's not much fun for holders.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Centennial Resource Development

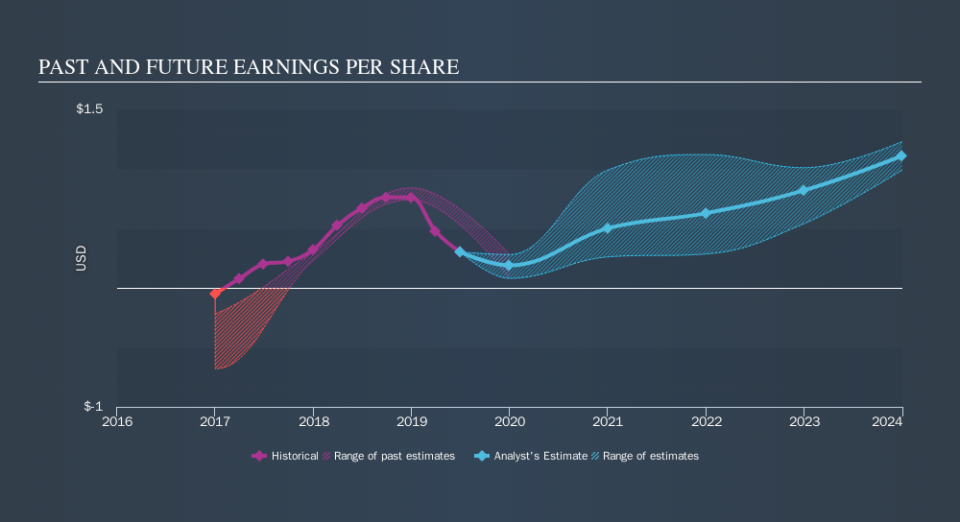

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unfortunately Centennial Resource Development reported an EPS drop of 55% for the last year. The share price decline of 83% is actually more than the EPS drop. So it seems the market was too confident about the business, a year ago.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Over the last year, Centennial Resource Development shareholders took a loss of 83%. In contrast the market gained about 1.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 38% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Centennial Resource Development by clicking this link.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.