If You Had Bought China Development Bank Financial Leasing (HKG:1606) Stock Three Years Ago, You'd Be Sitting On A 13% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But if you try your hand at stock picking, your risk returning less than the market. We regret to report that long term China Development Bank Financial Leasing Co., Ltd. (HKG:1606) shareholders have had that experience, with the share price dropping 13% in three years, versus a market return of about 37%. The share price has dropped 14% in three months. But this could be related to the weak market, which is down 7.5% in the same period.

View our latest analysis for China Development Bank Financial Leasing

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate three years of share price decline, China Development Bank Financial Leasing actually saw its earnings per share (EPS) improve by 21% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past. We're actually a quite surprised to see the share price down while EPS have grown strongly. Therefore, we should look at some other metrics to try to understand why the market is disappointed.

We note that the dividend seems healthy enough, so that probably doesn't explain the share price drop. It's good to see that China Development Bank Financial Leasing has increased its revenue over the last three years. If the company can keep growing revenue, there may be an opportunity for investors. You might have to dig deeper to understand the recent share price weakness.

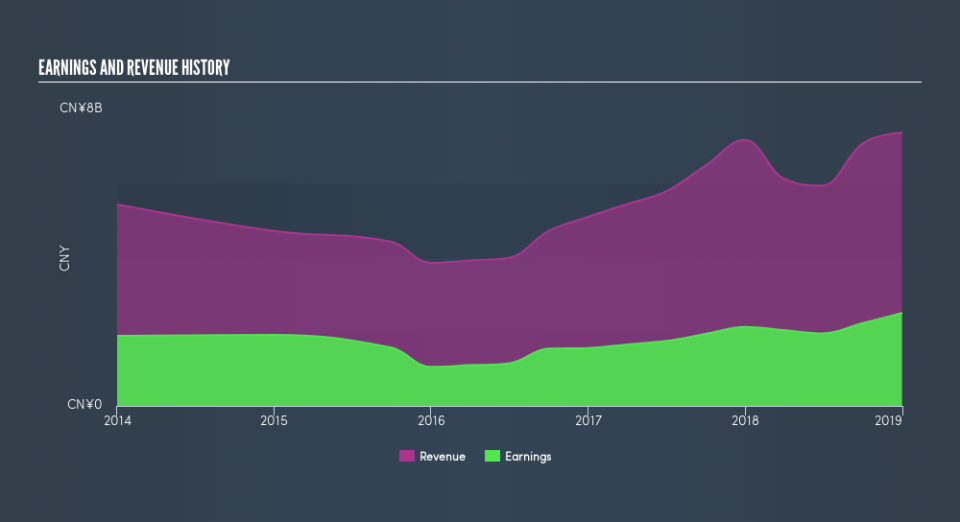

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on China Development Bank Financial Leasing

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, China Development Bank Financial Leasing's TSR for the last 3 years was 0.8%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that China Development Bank Financial Leasing shareholders have gained 12% (in total) over the last year. And yes, that does include the dividend. So this year's TSR was actually better than the three-year TSR (annualized) of 0.3%. The improving returns to shareholders suggests the stock is becoming more popular with time. Importantly, we haven't analysed China Development Bank Financial Leasing's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.