If You Had Bought DCD Media (LON:DCD) Stock Five Years Ago, You'd Be Sitting On A 48% Loss, Today

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term DCD Media Plc (LON:DCD) shareholders for doubting their decision to hold, with the stock down 48% over a half decade. And it's not just long term holders hurting, because the stock is down 27% in the last year.

View our latest analysis for DCD Media

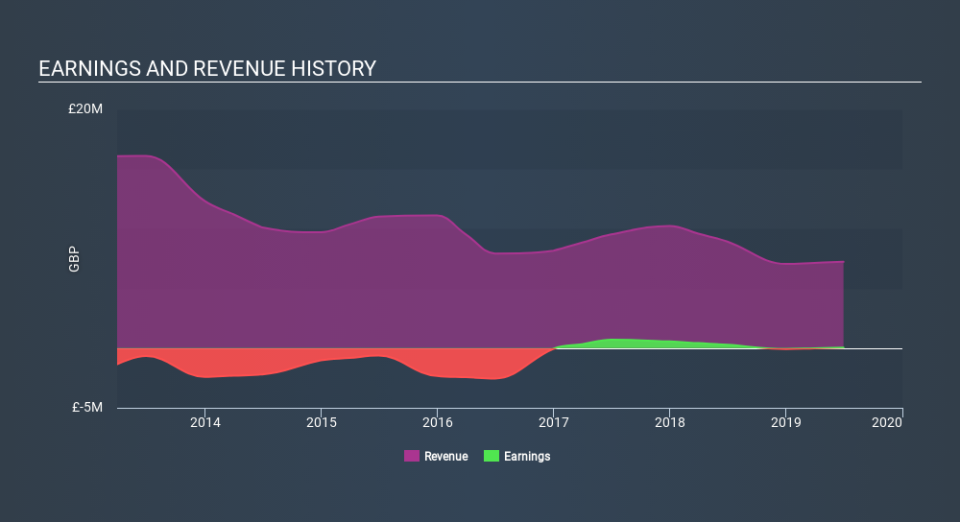

Given that DCD Media only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last five years DCD Media saw its revenue shrink by 6.4% per year. That's not what investors generally want to see. The stock hasn't done well for shareholders in the last five years, falling 12%, annualized. But it doesn't surprise given the falling revenue. Without profits, its hard to see how shareholders win if the revenue keeps falling.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of DCD Media's earnings, revenue and cash flow.

A Different Perspective

DCD Media shareholders are down 27% for the year, but the market itself is up 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand DCD Media better, we need to consider many other factors. Be aware that DCD Media is showing 3 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.