If You Had Bought Deveron UAS (CSE:DVR) Stock Three Years Ago, You'd Be Sitting On A 27% Loss, Today

It's nice to see the Deveron UAS Corp. (CSE:DVR) share price up 16% in a week. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 27% in the last three years, significantly under-performing the market.

View our latest analysis for Deveron UAS

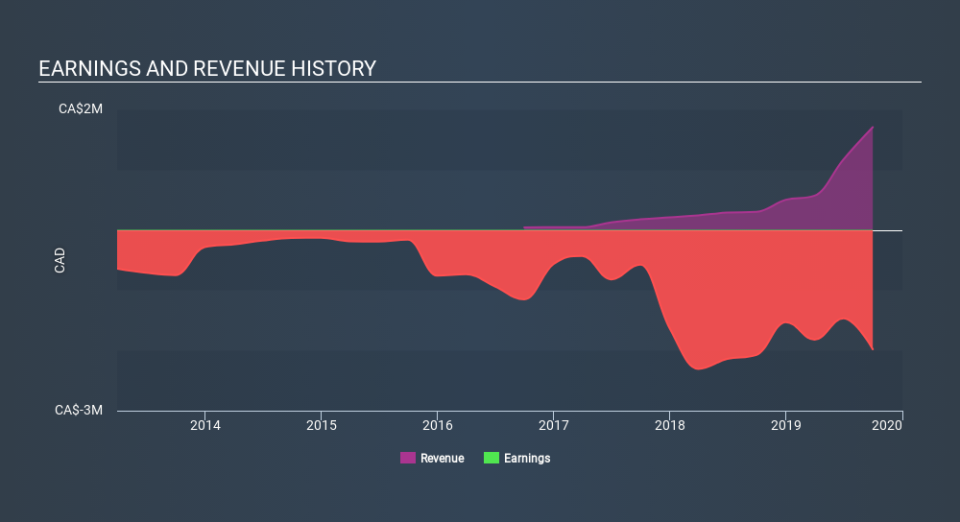

Deveron UAS wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Deveron UAS saw its revenue grow by 101% per year, compound. That's well above most other pre-profit companies. While its revenue increased, the share price dropped at a rate of 9.8% per year. That seems like an unlucky result for holders. It's possible that the prior share price assumed unrealistically high future growth. Still, with high hopes now tempered, now might prove to be an opportunity to buy.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Deveron UAS produced a TSR of 13% over the last year. Unfortunately this falls short of the market return of around 19%. The silver lining is that the recent rise is far preferable to the annual loss of 9.8% that shareholders have suffered over the last three years. It could well be that the business is stabilizing. If you would like to research Deveron UAS in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.