If You Had Bought DorianG (NYSE:LPG) Shares A Year Ago You'd Have Earned 89% Returns

A diverse portfolio of stocks will always have winners and losers. But the goal is to pick stocks that do better than average. Dorian LPG Ltd. (NYSE:LPG) has done well over the last year, with the stock price up 89% beating the market return of 81% (not including dividends). Looking back further, the stock price is 83% higher than it was three years ago.

See our latest analysis for DorianG

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

DorianG was able to grow EPS by 25% in the last twelve months. The share price gain of 89% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

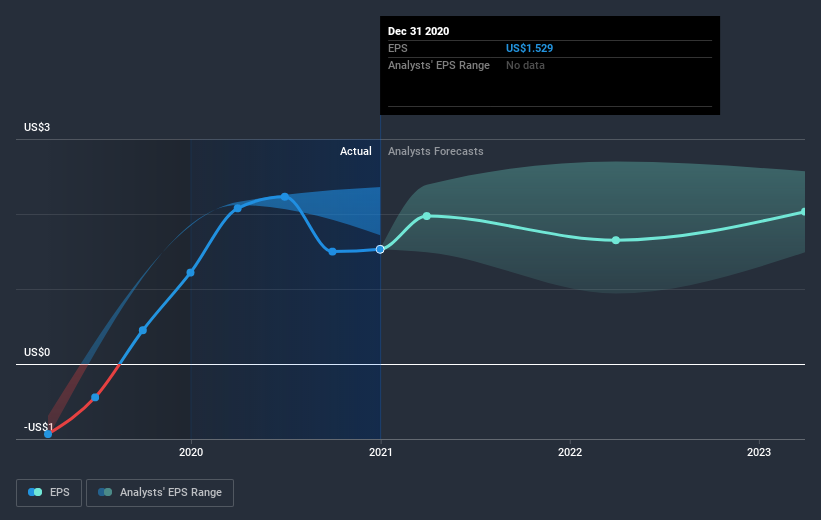

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that DorianG has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

DorianG's TSR for the year was broadly in line with the market average, at 89%. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 9%. It is possible that management foresight will bring growth well into the future, even if the share price slows down. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with DorianG (including 1 which is a bit unpleasant) .

But note: DorianG may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.