If You Had Bought Energean Oil & Gas (LON:ENOG) Shares A Year Ago You'd Have Made 43%

It hasn't been the best quarter for Energean Oil & Gas plc (LON:ENOG) shareholders, since the share price has fallen 17% in that time. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. In that time we've seen the stock easily surpass the market return, with a gain of 43%.

See our latest analysis for Energean Oil & Gas

Given that Energean Oil & Gas only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Energean Oil & Gas grew its revenue by 82% last year. That's well above most other pre-profit companies. The solid 43% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. So quite frankly it could be a good time to investigate Energean Oil & Gas in some detail. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

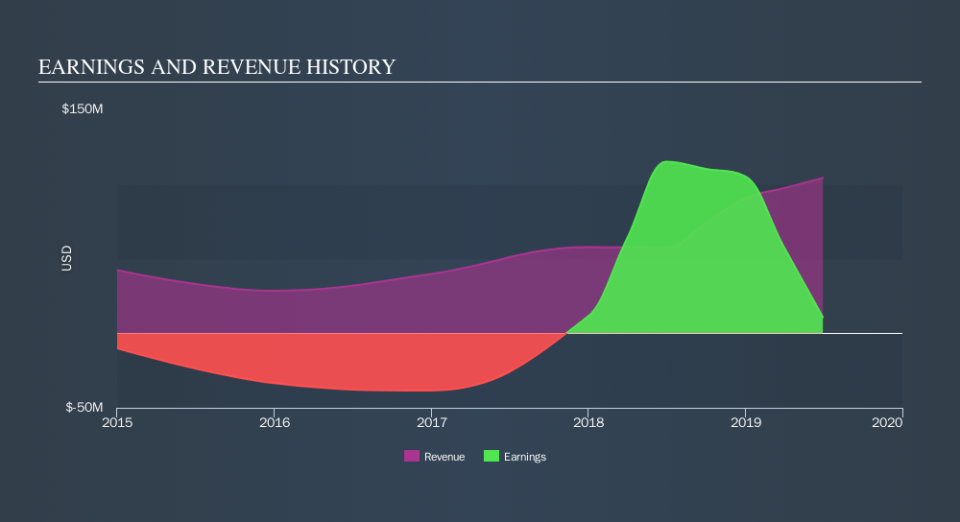

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Energean Oil & Gas stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Energean Oil & Gas shareholders should be happy with the total gain of 43% over the last twelve months. We regret to report that the share price is down 17% over ninety days. Shorter term share price moves often don't signify much about the business itself. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.