If You Had Bought Family Zone Cyber Safety (ASX:FZO) Shares A Year Ago You'd Have Earned 429% Returns

Family Zone Cyber Safety Limited (ASX:FZO) shareholders might be concerned after seeing the share price drop 12% in the last month. But over the last year the share price has taken off like one of Elon Musk's rockets. Few could complain about the impressive 429% rise, throughout the period. So we wouldn't blame sellers for taking some profits. While winners often keep winning, it can pay to be cautious after a strong rise.

Check out our latest analysis for Family Zone Cyber Safety

Family Zone Cyber Safety isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last twelve months, Family Zone Cyber Safety's revenue grew by 61%. That's well above most other pre-profit companies. But the share price seems headed to the moon, up 429% as previously highlighted. Despite the strong growth, it's certainly possible the market has gotten a little over-excited. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

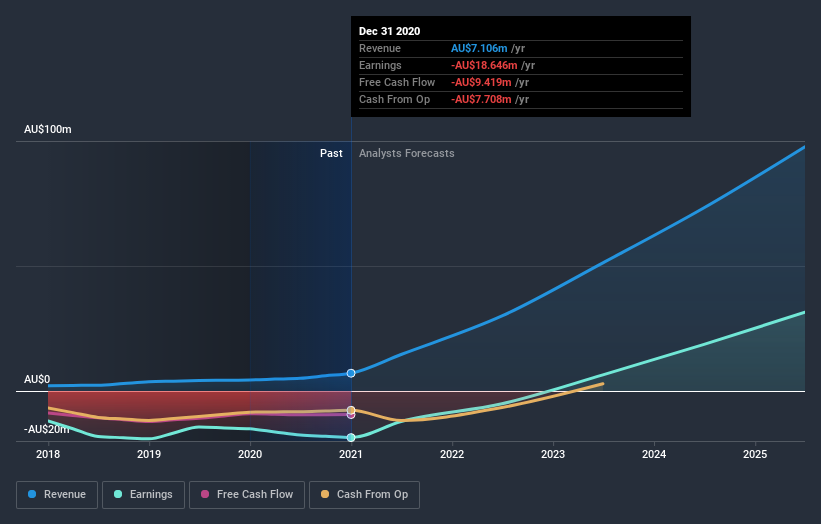

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Family Zone Cyber Safety in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that Family Zone Cyber Safety shareholders have gained 429% (in total) over the last year. This recent result is much better than the 7% drop suffered by shareholders each year (on average) over the last three. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Family Zone Cyber Safety you should be aware of.

Family Zone Cyber Safety is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.