If You Had Bought FRP Holdings (NASDAQ:FRPH) Stock Five Years Ago, You Could Pocket A 53% Gain Today

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can do a lot better than that by buying good quality businesses for attractive prices. For example, the FRP Holdings, Inc. (NASDAQ:FRPH) share price is 53% higher than it was five years ago, which is more than the market average. In stark contrast, the stock price has actually fallen 6.3% in the last year.

Check out our latest analysis for FRP Holdings

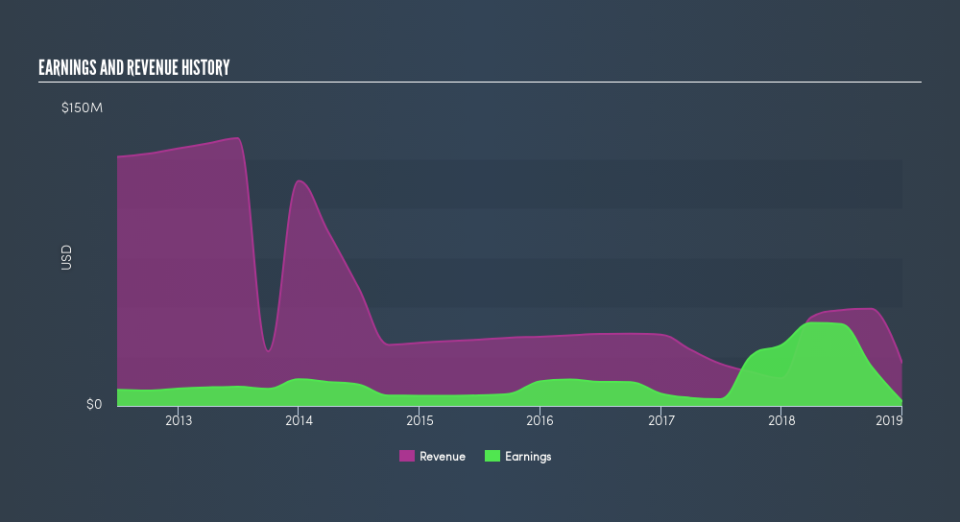

We don't think that FRP Holdings's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last half decade FRP Holdings's revenue has actually been trending down at about 19% per year. Despite the lack of revenue growth, the stock has returned a respectable 8.9%, compound, over that time. It's probably worth checking other factors such as the profitability, to try to understand the share price action. It may not be reflecting the revenue.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on FRP Holdings's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered FRP Holdings's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that FRP Holdings's TSR, at 62% is higher than its share price return of 53%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

FRP Holdings shareholders are down 6.3% for the year, but the market itself is up 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.